Pre-retirees may need to take on more risk ahead of retirement

Many Australians close to retiring won’t have nearly enough super to live on during their golden years and may need to invest more money in higher-risk assets such as shares to meet their retirement needs. The sad reality is that many seniors don’t have enough in their nest egg to live comfortably, and may need to watch their budgets very closely.

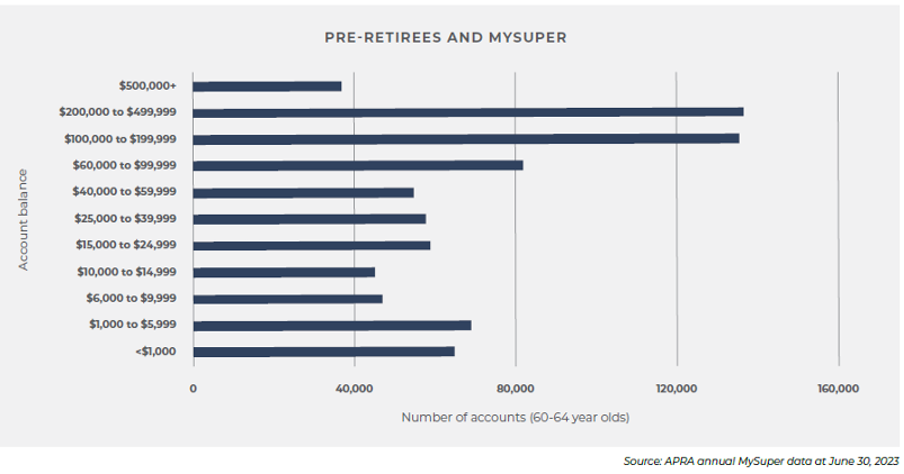

An analysis of APRA data by Innova Asset Management reveals that about 60 per cent of MySuper accounts held by pre-retirees, or those aged between 60 to 64 years, had low savings balances below $100,000 – or around 800,000 accounts, as the chart below shows. That is not nearly enough to fund a comfortable twenty or thirty years in retirement and will leave many retirees relying on Age Pensions for income.

A 65-year-old Australian woman today can expect to live another 23 years, and a 65-year-old man another 20.3 years longer.[1] Taking the ASFA retirement standard, which defines the level of savings required for retirement at age 67, a couple would need $690,000 while a single person would need $595,000 to live reasonably comfortably. With around 800,000 accounts having balances of less than $100,000, many older Australians simply won’t be able to afford a comfortable retirement in the last decades of their lives.

Official data highlights low super savings

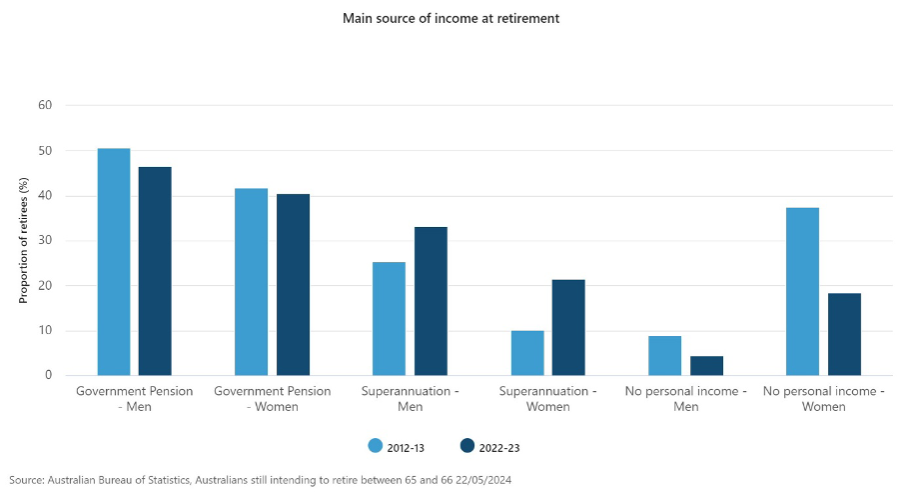

Recent data released by the Australian Bureau of Statistics (ABS) highlights the superannuation savings shortfall affects many of those people who have already retired. In 2022–23, a government pension or allowance was still the main source of personal income at retirement for 43 per cent of retirees. This was followed by superannuation, an annuity or private pension at 27 per cent. Notably, men rely far more on a government pension or allowance for retirement income than women at 51 per cent of male retirees, compared to 42 per cent for women. However, women still are far more likely than men to report having ‘no personal income’ in retirement (18 per cent of women retirees compared to just 4 per cent of male retirees, as the chart below shows.

But there is some good news. The ABS pointed out that over the past decade, the number of people who said they had no personal income has fallen to 12 per cent in 2022–23, down from 25 per cent in 2012–13. The percentage of women reporting no personal income had dropped considerably, down to 18 per cent from 37 per cent in 2012–13. The number of women retirees who relied on their partner’s income as their main source of funds for meeting living costs also fell by more than 10 percentage points over the decade, dropping to 31 per cent in 2022–23 from 44 per cent in 2012–13, ABS data shows.[2]

The most common factors influencing older workers’ decision to retire were, no surprise, financial security (36 per cent) and personal health or physical abilities (22 per cent). Around one in eight retirees (14 per cent) said reaching the eligibility age for an age or service pension was one of the main factors influencing the decision when to retire. On average, women retire sooner than men, the ABS data show. However, women are retiring later than in previous years as they extend their working lives, which is another factor that will help increase their superannuation savings, though many women still need much, much more.

Financial advice may be needed for more effective asset allocation

The above numbers suggest that a significant cohort of older Australians may need to seek financial advice during the critical years before retiring to boost their level of retirement savings. The advice doesn’t need to be all-encompassing financial advice; it could be limited to areas such as retirement and the need to change asset allocation depending on one’s needs, which could potentially more than pay for the cost of financial advice.

While the typical advice for a pre-retiree is to lower investment risk as retirement approaches, reducing exposure to growth assets may not be a good strategy for pre-retirees with low savings balances. Some pre-retirees may be better served by maintaining or allocating more aggressively to growth assets such as shares and investing less in cash and bonds, given their need for more wealth creation and better long-term returns.

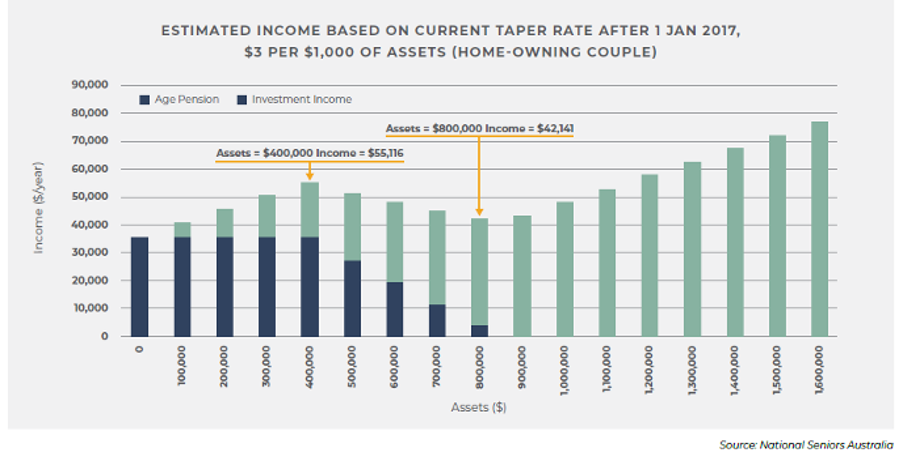

It's also important to note that the Age Pension isn’t much help, given the ‘taper trap,’ or the outcome that as superannuation savings grow, the value of the Age Pension is cut by an even greater amount thanks to rules in Australia’s retirement system, as the chart below shows. In effect, the taper rate means that some individuals are getting less income even though they have more retirement savings. A financial adviser can help to manage this risk and produce a higher level of superannuation savings overall, an essential goal for those with low balances.

Innova’s analysis of the APRA data reveals that 46.4 per cent of the nearly 1.7-million-member accounts held by 60- to 64-year-old Australians were invested in MySuper funds at June 30, 2023.

MySuper funds are intended as low-cost, simple products suitable for most investors. Most are balanced funds, with a static 70:30 growth-defensive asset portfolio allocation. Yet as this analysis reveals, MySuper products are not the answer for many investors. They were designed to cater for a largely disengaged customer base given superannuation’s distant payoff.

Those people least likely to be engaged – and invest in default MySuper products – include older people with lower education, on lower incomes and/or with lower financial literacy. Our research highlights the need for advice to build up their superannuation savings much earlier in life and potentially invest in more aggressive investment products to fund a comfortable retirement, which is still out of reach for many Australians.

[1] https://www.canstar.com.au/life-insurance/whats-your-life-expectancy/

[2] https://www.abs.gov.au/media-centre/media-releases/australians-still-intending-retire-between-65-and-66