SMSFs pile into property and cash, while debt investments left behind

Growth in house prices in Australian capital cities could accelerate in the second half of 2024 and in 2025, with the housing shortage likely to worsen as population growth feeds demand for housing with supply not keeping up as building approvals drop, underpinning further gains in property prices and rents.

While that is good news for SMSFs, which are heavy investors in the property market, some funds could consider diversifying their portfolios into fixed-income assets to spread their risks. New data from the Australian Taxation Office (ATO) reveals SMS have almost a $150 billion exposure to direct Australian property investments alone, with residential and non-residential property investments totalling a record $141.8 billion in the March 2024 quarter, up from $133.5 billion in the December quarter. That represented 15 per cent of their total net assets, which sat at $932.9 billion as at 31 March 2024.[1]

SMSFs invested a near record $145.1 billion in cash and deposits, or around 15 per cent of total assets. Another $287.1 billion was invested in Australian and overseas shares, or around 31 per cent of total SMSF assets. SMSFs invested just $9.5 billion directly in debt securities and $6.5 billion in loans. With such high allocations to Australian property, shares and cash, SMSFs would benefit from assessing asset allocations to consider greater allocations to fixed-income investments, which can deliver more attractive yields than property. But more on that later as we examine what is likely to happen to property prices in the year ahead.

Price rises seen all around Australia

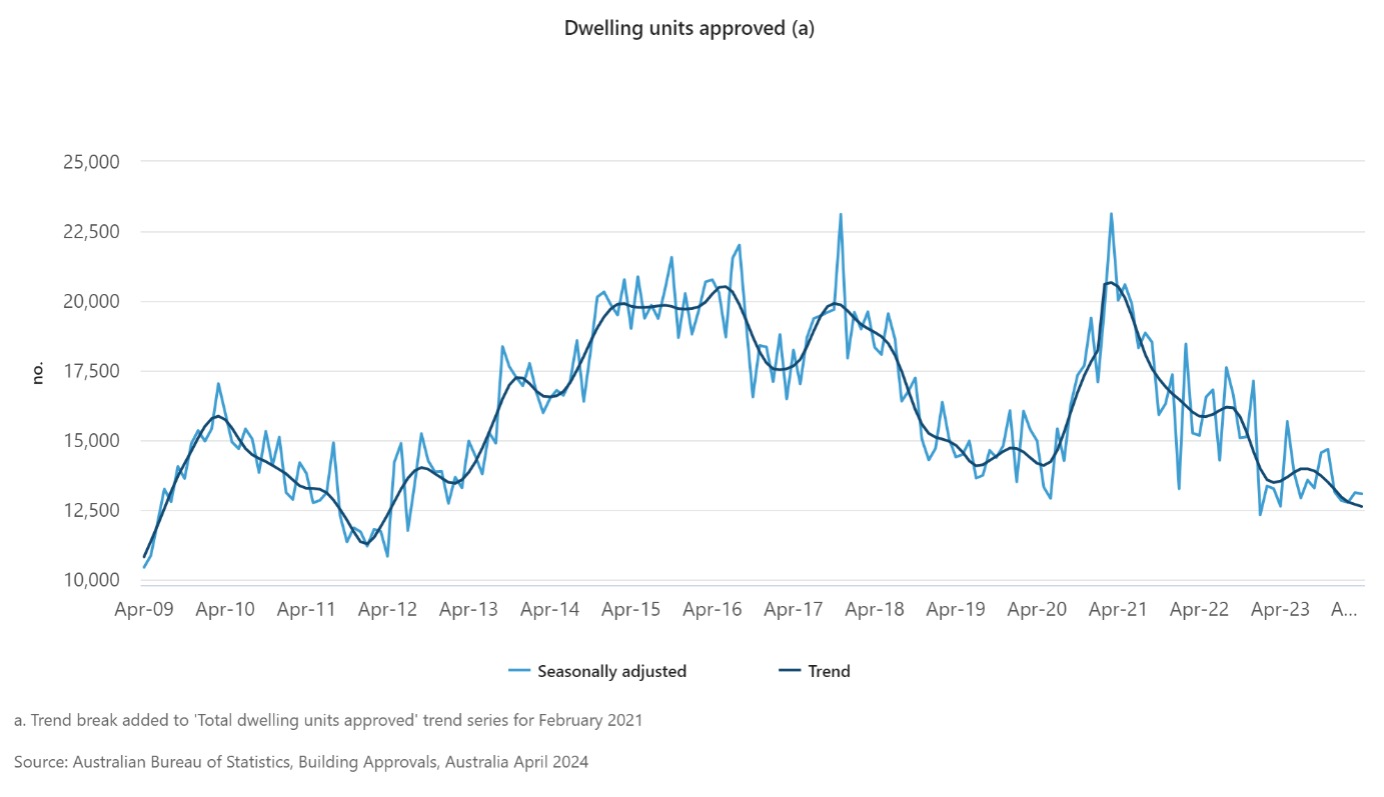

At least in the short to medium term, the probability of price rises for houses and units is high, with the housing market moving further into undersupply over the next 24 months. The sharp fall in building approvals over the last two years will keep upward pressure on property prices as the housing supply needed to accommodate a growing population falls well short of demand.

Higher interest rates are weighing on the construction of units and houses around Australia, as well as the high level of inflation for building construction materials. The housing shortage is likely to worsen given the sharp drop in the number of dwellings approved since early 2021 (as the chart below shows), which will keep upward pressure on residential property prices and rents. Ongoing population growth will put further pressure on rental markets nationally.

Investors drawn to property

With the high level of interest in the property market, investor demand for housing has soared, despite higher rates, over the past year. The value of investor home loans rose 3.8 per cent in March 2024 to $10.2 billion, increasing a significant 31 per cent from March 2023.[1] In contrast, owner-occupier loans (excluding first home buyers) rose just 9 per cent through the year, ABS data show.

While property owners have benefited from price rises, investors should consider diversifying their portfolios into assets outside property. Recently released economic data, ABS Household wealth data,[2] shows household net wealth sat at a record $15.50 trillion in the December 2023 quarter, boosted by a record level of property assets of $10.50 trillion as at 31 December 2023. As a proportion of net household wealth, residential property accounted for around 64.5 per cent, up from 61.7 per cent in December 2020.

For SMSFs, while their portfolios are more diverse than those of Australian households, the advantages of diversifying into fixed-income assets, from which they can draw an income, are clear. Ultimately, it is income-yielding assets that will support investors in everyday living and in retirement.

SMSF investment strategies could consider diversification into private credit, or non-bank loans to corporations, which offer investors a relatively attractive income stream and capital protection through stringent loan process, along with the security taken over borrower assets. Yields on private credit funds are close to 10 per cent per annum, much higher than yields on cash or property.

Given its appeal, several larger industry superannuation funds, such as AustralianSuper, are investing in private credit. Australia’s largest superannuation fund is one of the largest investors and has allocated over US$4.5 billion (A$7 billion) in private credit globally. It stated in December 2023 its ambition to triple its exposure in the coming years. “AustralianSuper is looking to increase its investments in private credit as it is an asset class [that] could have the potential to provide attractive income, returns and stability during uncertain economic times,” the super fund said in a media release.

Separately, the biggest investment allocations UniSuper has made into any asset class over the past 18 months have been in the debt markets, not in equity markets. While the fund is holding back on allocating any more to investment-grade bonds, believing them to be expensive, UniSuper’s chief investment officer, John Pearce, recently told The Wall Street Journal[3] that he is still taking bets on private credit.

Compared to equity markets, which are arguably fully valued, private credit provides investors with attractive yields and much lower volatility. And with inflation remaining elevated and sticky, this will favour yields on private credit, with interest rates on corporate loans typically floating rate, allowing investors to take advantage of interest rates in a higher for longer scenario. Once solely the domain of institutional investors, SMSF investors can now access the benefits of private credit investments.

[1] Strong growth in the value of home loans through the year

[2]Australian National Accounts: Finance and Wealth

[3] Australian Pension Fund UniSuper Grows Private Credit Exposure