How to benefit from rising interest rates

While we all know that rising interest rates is good news for term deposits savers, there are other investments that also benefit from rising interest rates and importantly, pay higher rates of return than term deposits.

While the big banks have raised interest rates on term deposits and savings accounts, interest rates on many of these products remain below 5%. Indeed, official data highlight that after inflation, the returns on some cash investments are close to zero. The average advertised interest rate on three-year term deposits, for example, was just 3.95% in May 2024, unchanged from a year ago, according to the most recent data from the Reserve Bank.[1] The one-year rate was a little better at 4.55%. Compared to an inflation rate of around 3.6%, that doesn’t leave much of a return for savers after accounting for inflation.

In addition to relatively low returns, term deposits involve locking up your money; savers won’t be able to access their money during the fixed period. Interest rates too are fixed for a term deposit and remain unchanged for the entire term even if there is another rise in official interest rates.

Yet some investments benefit from higher interest rates and offer some flexibility when compared to term deposits. This includes fixed income investments which have “floating rate” coupons or returns. Floating rate investments, including corporate loans made by private credit funds, offer an interest rate that is linked to variable interest rates, so it will generally increase in a rising rate environment. With the potential for another official rate rise in August 2024, that means that the yield earned on floating rate investments could increase over the next 12 months, unlike the interest rates on one-year or three-year term deposits which are fixed.

For income-seeking investors who are willing to take on more risk than that involved with a cash or term deposit, private credit investments can deliver investors yields close to 10% per annum, which is almost double typical yields on cash and up to four times the yields on rental properties which fall below 5%. Another benefit of floating rate loans is that they typically display low correlation to equities, so this asset class may help to insulate against share market declines.

Need to diversify asset base out of property

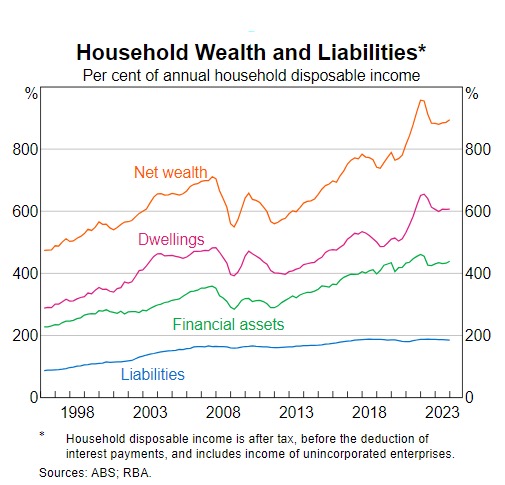

One thing is likely; one asset class that probably won’t do well if interest rates rise again is residential property. Australians are stockpiling their wealth in residential property, with new data from the Australian Bureau of Statistics showing around two-thirds of household wealth is now held in residential property, a proportion which has increased over time with property values. Along with very high levels of household debt, this has raised the need for Australians to diversify into other defensive asset classes to reduce the risk of their wealth being hit by higher interest rates or a share market correction.

The ABS wealth data shows that household net wealth rose to a record $16.2 trillion in the March 2024 quarter, boosted by a record level of property assets of $11.0 trillion. As a proportion of net household wealth, residential property accounted for around 67.9%, up from 61.7% in December 2020.

Property has been a key driver of household wealth gains in recent years, as the chart below from the Reserve Bank shows.

Yet while property accounts for most of household wealth, private credit, or non-bank loans to corporations, offers something property doesn’t: an attractive yield. That is one of the main reasons that Australia's largest institutional investors such as AustralianSuper and UniSuper are allocating more to private credit assets.

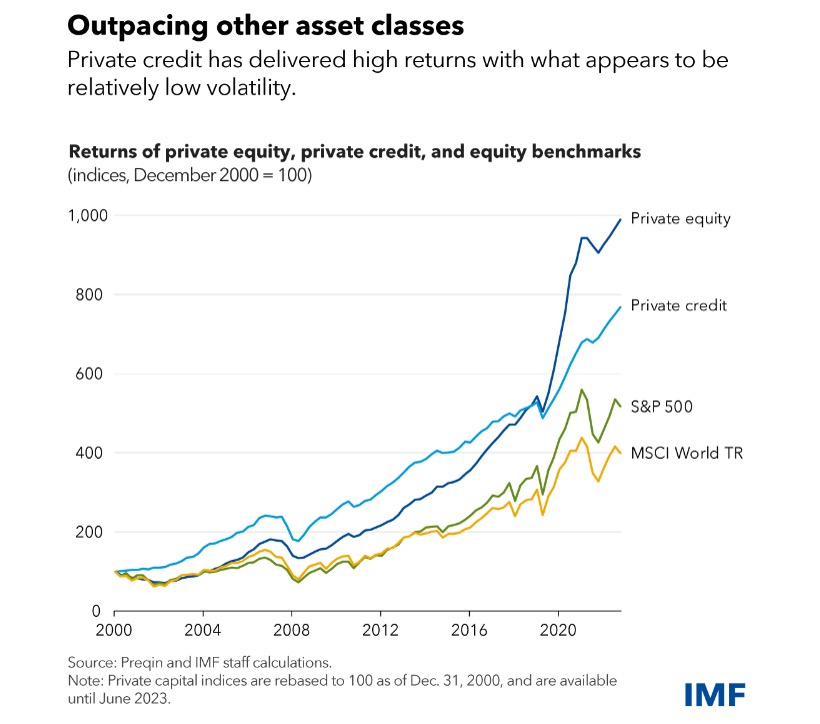

Over time, we expect individual investors to follow the lead. Private credit investments do not attract the large stamp duty impost or require a large initial deposit such as is required for residential property purchases. Instead, private credit is accessible and offers reliable income for all investors, including retirees, which is why super funds are piling into this asset class.Globally, this is the case too. The International Monetary Fund (IMF) recently noted in this research paper the sharp growth of private credit asset allocations, with most demand coming from institutional investors such as superannuation funds, due to the asset’s offer of relatively high yields and low volatility. The chart below from the IMF displays that growth.

With share markets hitting records and valuations high versus historic long run averages, markets could correct over the next 12 months; private credit offers investors the potential for downside protection in this environment and diversification into an attractive, defensive asset class with features and characteristics that mitigate several investor concerns.