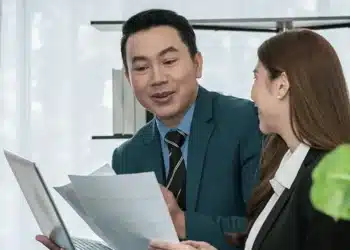

‘Collective impact’ of Div 296 bill will affect all superannuation members

Peter Burgess, CEO of the SMSF Association, said it is for this reason that he is hoping the superannuation sector will join forces to push for amendments that will ultimately benefit every Australian. In the most recent SMSF Adviser podcast, Burgess said it is “certainly possible” that the bill will be introduced to Parliament next month given that due process is normally a month. “The...

Read moreDetails