The Emerging Affluent woman: millennial women with money

Many members of Gen Y and Z have money and they want to know how to spend it. Here’s what the female Emerging Affluent want and need.

Key takeaways

- Young women with high incomes are the group most likely to seek advice and be engaged with their investments

- They are less risk averse than other demographics of female investors

- Responsible investing is important to them

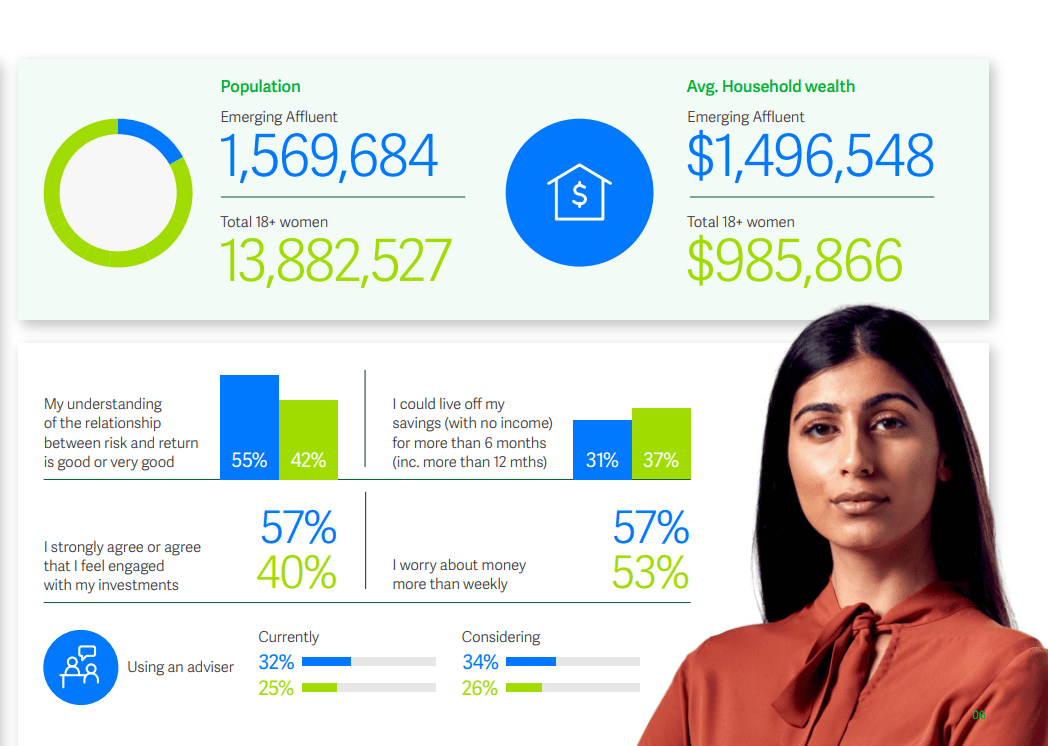

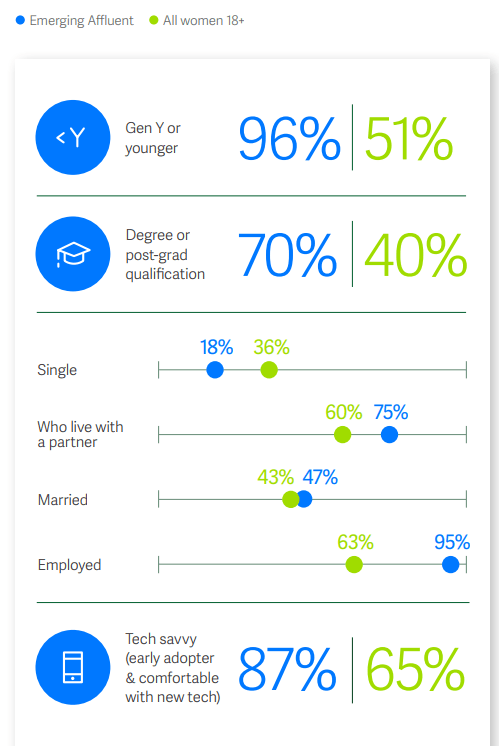

She’s aged between 18 and 42 and has a household wealth of around $1.5 million. She’s likely tertiary-educated and is employed and tech savvy. It’s possible she is married or has a partner, and maybe children, which means she has growing wealth needs.

Meet the Emerging Affluent woman. For advisers looking to increase their offerings for women, this segment is worth a look. Because while a lot of focus for advice is on the baby boomer generation, this up-and-coming wealthy segment are in need of advice as well. They’re also a group that is keen to learn, has plenty of financial goals and is very likely to seek financial advice.

The Emerging Affluent female at a glance

Netwealth’s Advisable Australian research first identified the group we call the Emerging Affluent — a group of people under about 45 (comprised of all genders) with higher-than-average incomes who are the upcoming generation of wealthy Australians.

So, it was a natural progression in Netwealth’s most recent research Women as the New Face of Wealth to look further into the advice needs of the female cohort of this group, who are approximately 10% of the Australian population 18+.

The research found Emerging Affluent women are engaged, knowledgeable and very advisable. This group are highly likely to use or seek financial advice — 32 per cent already do so (vs. 25 per cent women overall), and a further 34 per cent are considering it in the future (vs. 26 per cent women overall).

Meanwhile, 57 per cent of Emerging Affluent women feel engaged with their investments, compared to 40 per cent of all women. The majority (55 per cent) rated their understanding of the relationship between risk and return as good or very good (versus 42 per cent overall), and most (87 per cent) rated themselves as tech-savvy early adopters (65 per cent overall).

At the same time, financial security is obviously a concern for them — 57 per cent worry about money more than weekly (compared to 53 per cent overall), while just 31 per cent could live off their savings with no income for more than six months, compared to 37 per cent of all women surveyed.

Financial goals and investing styles

When it comes to investing, this group shares some characteristics of female investors as a whole, however there are some notable differences which advisers would do well to note when tailoring their offerings.

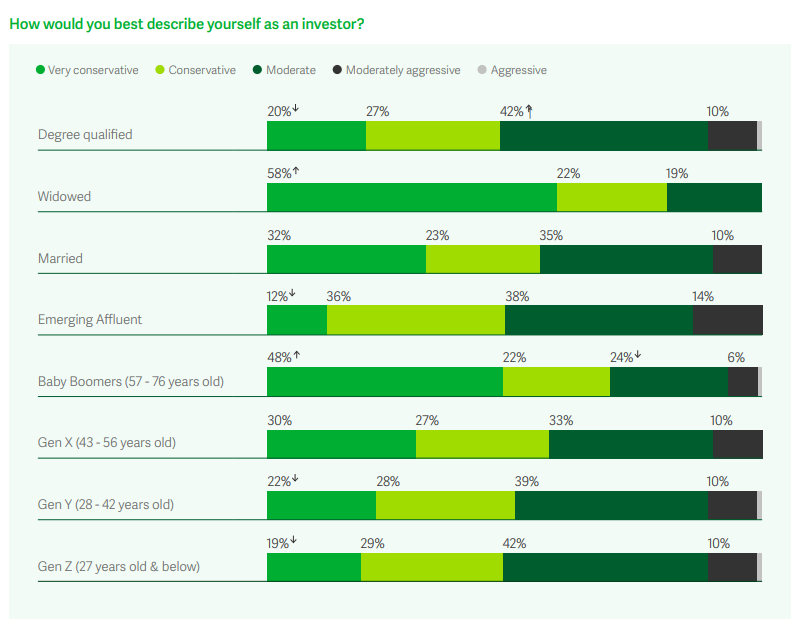

For example, Netwealth’s research found that while overall, women are largely conservative investors, this is less so in the younger and more affluent end of the spectrum.

In fact, only 12 per cent of the Emerging Affluent rated themselves as ‘very conservative and avoiding any exposure to risky assets’, far less than the 31 per cent who selected this overall. And 38 per cent are ‘moderate – looking for stable and reliable returns without much risk’ (compared to 33 per cent overall). On the other hand, 14 per cent rated themselves as moderately aggressive and looking to invest in some riskier assets for higher returns (compared to nine per cent overall).

Another key area for Emerging Affluent women is ethical investments. In general, women care deeply about environmental issues (59 per cent) and social issues (54 per cent), but this is even higher for female Emerging Affluents (70 per cent and 66 per cent respectively).

While only a quarter of females (24 per cent) currently hold responsible investments in their portfolio, this is significantly higher for Emerging Affluents, which are held by 44 per cent. And 82 per cent of those who don’t have ethical investments would consider them if it didn’t involve paying more or sacrificing returns and it made a quantifiable contribution to the environment or society.

Emerging Affluent females are more likely to have goals that go beyond pure investing, particularly when it comes to the day-to-day. For example, 78 per cent said one of the financial and wealth goals they’re actively working towards is creating and sticking to a budget — this is significantly higher than all women, where the number is 59 per cent.

Other significant goals include saving for something substantial like a house deposit (75 per cent); saving for something less substantial like a car (78 per cent); managing household expenses (75 per cent); and working towards having a passive income stream (75 per cent).

The Emerging Affluent woman is also likely to have financial goals such as ensuring their family could manage wealth if they passed away (75 per cent) and arranging or reviewing insurance (75 per cent).

Emerging Affluent women are hungry for knowledge, with 84 per cent agreeing ‘I’m eager to learn about money matters’ compared to 55 per cent of all women surveyed.

How to reach young affluents

When looking at how to reach this burgeoning market segment, it’s helpful to look at where younger investors turn for information. For example, when asked to nominate typical sources of information and advice about investing, 48 per cent of Gen Zs and 43 per cent of Gen Y rely on friends and family. Gen Y are the biggest users of specialist investment websites, blogs and apps, with 31 per cent compared to 22 per cent of Gen Ys, and 23 per cent of both Ys and Zs are keen to turn to social media.

And when it comes to finding a financial planner, the Emerging Affluent females turn to family, friends or colleagues (49 per cent). Other personal recommendations are likely to come from asking their bank (24 per cent), followed by a professional industry association (18 per cent), lawyer/solicitor (18 per cent), accountant (15 per cent), mortgage broker (15 per cent) and workplace (15 per cent).

Online sources are a popular alternative. Google is used by 20 per cent, followed by online rating and review websites (16 per cent), but just nine per cent use online forums and the ASIC financial adviser register, and two per cent social media.

So it may take some effort to tailor your offering and proposition to attract these clients, but it’s well worth the effort for receptive, wealthy and advisable clients that will last well into the future.