Trumping geopolitical uncertainty in SMSF portfolios: Thinking global and acting local

Promoted by Cashwerkz.

You've got to ask yourself one question: "Do I feel lucky?"

Clint Eastwood in Dirty Harry (1971)

Australian equity markets have had a rough ride over the last six months. Many of the ASX top 20 blue chip names that are the backbone of a large number of self-managed superannuation funds (SMSFs) have bounced around significantly, in part due to global forces (think U.S. lead sell-offs) and in part due to the immense policy uncertainty that has engulfed both key foreign markets (Brexit, U.S. mid term elections and interactions with China, amongst others) and the political agenda here in Australia (such as the potential for a change in Federal Government and associated franking credit, negative gearing and capital gains tax proposals that have been floated).

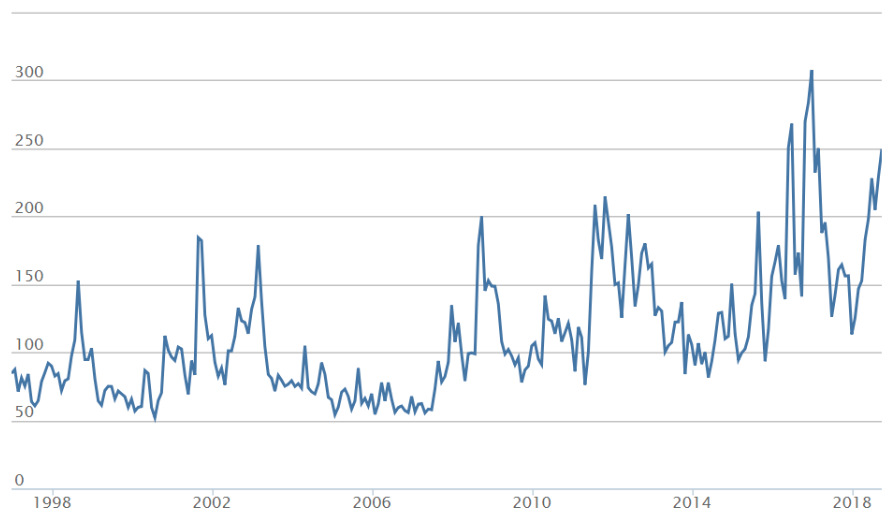

The chart below shows the significant correlation between the ASX top 200 (XJO) and the ASX top 20 (XTL) and the amount of volatility that has been experienced:

Source: www.asx.com.au

The following chart shows an index of global policy uncertainty based on various measures of disagreement between economic forecasters, meta-analysis of mainstream media and the like between 1997 and 2018 – as you can see from this chart, we’re definitely in uncertain territory, with a significant uptick in the measure of policy uncertainty.

Source: http://www.policyuncertainty.com/index.html

So how could investors position their portfolios to deal into this type of environment?

The answer to this question is complex and will be based on the specific goals, objectives and circumstances of the actual investor, however at an industry wide level, a number of high-level themes have started to develop.

According to Rob Hay, Head of Advised Distribution at Cashwerkz “some investors have been taking risk out of their portfolios, either progressively through selective non-participation in dividend re-investment plans, or upfront through the strategic sale of risk assets with a view to re-entering equity markets opportunistically as and when they see value emerging”.

Hay continues, “the issue for investors adopting these strategies is how they manage the proceeds from extra dividend receipts or asset sales in order to generate competitive returns for their SMSF and actually get paid to wait for value to return, rather than allow low (or no) interest on the incumbent bank account to effectively pay to wait”.

So how do you know if you’re getting a good rate or not? Do you rely on luck or is there something else that could possibly be done?

Technology has come along way in solving this problem and in facilitating the efficient lodgement and maturity management processes associated with term deposit investing – all of which can now be done online and with as little as three clicks of a mouse.

There are clearly benefits in doing this.

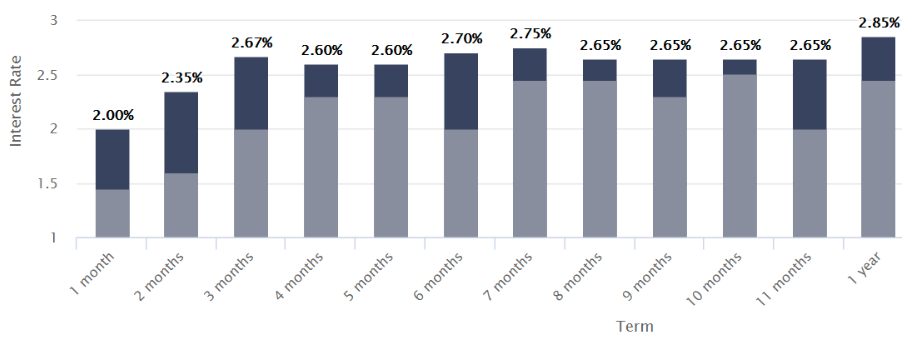

As the chart below shows, the spread (or difference between the highest and lowest term deposit rate) can vary significantly based on the term you pick and the institution you bank with. Indeed, over common time periods such as 6 months, the spread is currently sitting at 70bps meaning that the consequence of inadvertently selecting the lowest interest rate could cost the SMSF (based on a $250,000 holding) up to $875!

Source: www.cashwerkz.com.au

To put the $875 differential into perspective, this would be enough to cover (with change) nearly three months worth of long lunches and restaurant dinners for a retired couple (age 65 – 85 who live comfortably) based on the June 2018 ASFRA Retirement Standard.

So for those investors looking to take some risk off the table, it can clearly pay to be active and make every dollar work as hard as possible and, as Hay concludes, “when technology breaks down the barriers and traditional frustrations of term deposit investing not only do investors have the potential for a better return – they also get more time back in their lives to spend on the things that really matter, which ultimately is what retirement is all about”.