SMSFs to be hit with higher admin penalties under Labor

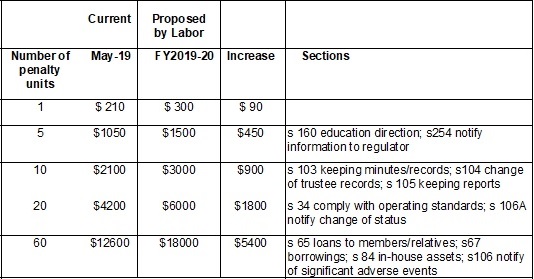

Labor has outlined in its costings that it will increase penalty units from $210 to $300, which would result in SMSF trustees receiving higher administrative penalties where they have contravened provisions, warns an industry law firm.

Last week, Labor released its costing document for its proposed changes including its proposals for dividend imputation and superannuation concessions.

The costings document also states that Labor intends to increase penalty units from $210 to $300 which is expected to raise $53 million in funds over 2019–20, $88 million in 2020–21, $101 million in 2021–22 and $112 million over 2022–23.

DBA Lawyers director Daniel Butler said this will give rise to a huge increase in the administrative penalties that can be imposed on SMSF trustees and directors.

Individual trustees and directors of corporate trustees are personally liable to pay an administrative penalty where they contravene certain provisions from the Superannuation Industry (Supervision) Act 1993 (SISA).

Mr Butler said that, in some cases, the administrative penalties imposed by the ATO can be hundreds of thousands of dollars. Increasing each penalty unit to $300 could further raise these costs.

Source: DBA Lawyers

SMSF auditors have previously pointed out that while administrative penalty regime has been effective at reducing the number of contraventions such as short-term loans to members, the penalties can be harsh where there are a large number of smaller transactions.

Mr Butler explained that penalties are automatically imposed by the ATO and it is up to the SMSF trustees or directors to see if they can obtain any remission.

This process, he said, can give rise to considerable professional representation costs and could even lead to financial ruin.

The impact of these penalties is more significant because where there are individual trustees, he noted, as administrative penalties are charged per trustee.

Miranda Brownlee

Miranda Brownlee is the deputy editor of SMSF Adviser, which is the leading source of news, strategy and educational content for professionals working in the SMSF sector.

Since joining the team in 2014, Miranda has been responsible for breaking some of the biggest superannuation stories in Australia, and has reported extensively on technical strategy and legislative updates.

Miranda also has broad business and financial services reporting experience, having written for titles including Investor Daily, ifa and Accountants Daily.