Cash flow modelling software to lower practice costs for SMSF specialists

Promoted by Financial Mappers.

Do you need to reduce your costs? Personal cash flow modelling software will save time, lower practice costs and improve client understanding.

The FPA’s Digital SOA initiative to lower practice costs

The FPA has stated that the model of giving a client 100-pages of information, is too complex for the client and too expensive for the adviser.

The FPA is commencing an initiative to design a digitally delivered client interactive SOA for better client engagement and understanding. They are currently establishing a committee with representatives from ASIC, legal experts, compliance officers, advisers, and the community, to set a new gold standard for the advisory industry. Getting the stakeholders to all agree may prove a challenge. Hopefully a much simpler SOA can be developed and then presented in an interactive digital format.

Financial Mappers will allow an adviser to deliver a great interactive eSOA or Client Review portal.

Reducing the prolonged planning process time

The 26.5 manhours required to create and present a new client SOA in its current format is a result of legislative requirements, legacy business processes, and software bloat. To drastically reduce planning time and costs requires software addressing all three issues.

The solution is personal cash flow modelling software.

The necessity to prove that all advice is in the client’s best interests and fits their total financial situation and risk parameters is a major factor in the cumbersome planning process and final SOA.

With Financial Mappers every stage of the planning process is shortened.

The client’s balance sheet with intentions, personal, retirement, and investment cash flows are analyzed with short targeted reports. Modelling of any single change or a “What If” scenario shows before and after-effects of every aspect of finances and generates new reports. Examination of complex alternate strategies and consideration of any inadvertent consequences elsewhere in a plan is instantaneous. Construction of an SOA is straightforward.

Demonstrating that all factors have been considered, and that advice is in the client’s best interests, is transparent.

Outdated business practices and legacy software

Does your practice require hours of getting to know your total client, hours to crunch the numbers on alternate strategies to achieve an optimum outcome, hours to construct a basic client plan, and hours more to deliver a formal SOA, and then discuss the implications with your client?

Does your practice outsource the writing of the SOA? If an SMSF adviser is spending $400 for each outsourced document, with 50-clients there is an immediate saving of $20,000 if the production of an SOA is more efficient and done in house.

Is your software now so difficult for you to use that you choose to outsource the process? You may have built up an inhouse IT team to keep the larger practice functioning. What could be the practice savings in reducing these overheads?

Using an outsourced paraplanner, is likely to be an additional cost of around $2,500 per client. Think about how much time the adviser takes to brief the paraplanner and then review the work of the paraplanner, for which the adviser is responsible.

Think of the potential practice savings if an adviser or SMSF specialist could immediately understand everything about the client, do any modelling of a plan within client’s risk parameters swiftly, and produce an SOA without recourse to outsourcing.

Think what happens if an advisor can easily use software which not only does all the above but demonstrates that any advice given has fully considered every aspect of the client’s finances, risks and intentions.

Cash flow modelling software for SMSF advisers

To demonstrate an SMSF account is an extremely complex matter. To incorporate an SMSF into the client’s total finances increases software functionality.

When everything in the SMSF is interlinked, the time taken for an adviser to demonstrate and arise at an optimum solution is minimized.

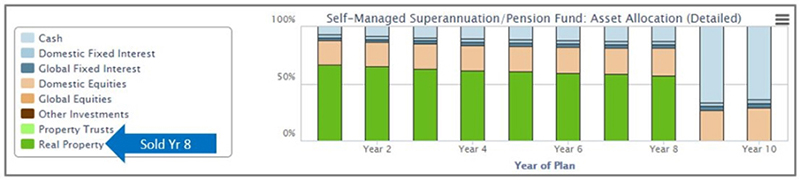

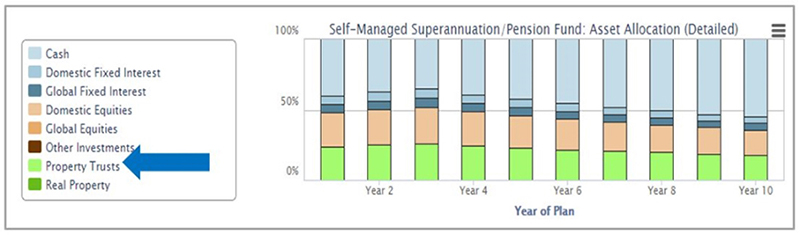

The following example shows Real Property versus a Property Trust held within an SMSF.

Here a single property leaves the client with a non-liquid asset and a too heavily weighted SMSF investment strategy. It also demonstrates the timing of property disposable to fund the drawdown.

The alternative is of allocating a percentage of assets to a Property Trust. Note the flexibility of changing the asset allocation over time.

By generating the report, Compare Two Plans, you display results side by side. This allows quick demonstration and selection of the best choice for the client’s property allocation.

Find out more about Financial Mappers

To find out more about Financial Mappers, see previous articles in the SMSF Adviser:

- SMSF cash flow modelling gives the numbers you need for the best decisions.

- Can you integrate your SMSF advice into your client’s wealth journey?

Register for our webinar, What makes good cash flow modelling software? and earn 1-CPD point. This webinar is available on-demand.

To find out more about Financial Mappers, follow the link.