Whilst yields for quality property have tightened over the past few years, the spread between quality property assets, interest rates and 10-year bonds has remained relatively static over the same period. We believe this means that yields in quality commercial property, continue to be a particularly attractive investment opportunity. Following the RBA reduction in interest rates to 0.75%, and with the potential to drop further, investors are recognising that cash may no longer be king – the investment world is going to deliver lower returns for longer periods.

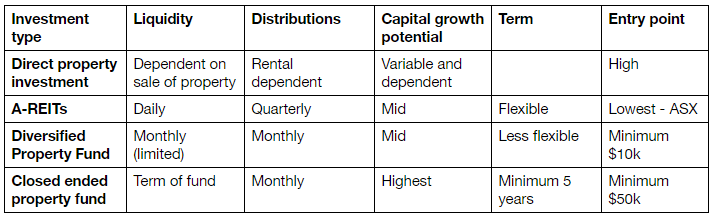

When we are talking to advisors and investors, they indicate that their property allocations usually make up somewhere between 15-30% of their portfolios. Recently we have seen a significant increase in demand for our unlisted property funds, driven by several factors, but one clear one being the desire for regular and relatively stable income. At present SMSF investors account for up to 60-70% of Centuria’s inflows into our Property investment offerings. Unlisted property funds are one of the few asset classes distributing monthly income above 6% p.a. and depending on an investor’s appetite for risk, this may compare favourably to other asset classes. The benefits of unlisted property funds stretch further. They are considered less volatile compared to listed property investments, as you are less affected by day to day market sentiment, however, this should be considered against the fact that unlisted funds have lower liquidity than the listed securities. Still, there are a several approaches to property investing that may help investors achieve the best of three.

Single asset unlisted property funds

Let’s look at the unlisted single asset fixed term funds first. Investors like to invest in these because they can choose the actual asset they are investing in; it’s not a portfolio that keeps growing so they know exactly what they have got; they can do their own due diligence on the tenants and the building; and so forth. A lot of these investors choose to gain diversification by investing in a number of these single asset unlisted funds. The distributions are paid monthly so the fund is generating an attractive regular distribution. Commercial leases usually have a term of three to ten years and depending on the property or tenancy profile, tenants may include government, ASX listed or blue chip companies. Hence some investors say they like the diversification of property as well as the stability of income.

High net worth (HNW) investors do sometimes look to buy a small property themselves, but some can find it difficult as it’s a very competitive space, especially in that $2-5 million price range. Whereby with single asset unlisted property funds, all investor types can enjoy exposure to high quality institutional grade commercial property ($100m – $200m), with high quality tenants through a smaller minimum investment entry point (generally around $50,000). So, what investors seem to like is that they can get blue chip tenants, institutional grade property and it’s a lot easier to invest than trying to find their own smaller investment property.

Some investors wrongly compare these funds to residential property investments, but the benefits compared to residential include: longer lease terms (sitting at between 3-15 years as opposed to six months); and reduced overhead costs (unlike a residential tenant, the commercial tenants pay for all the repairs, maintenance, property management fees and rates in the building); and of course net distribution returns that will often compare favourably (after factoring in gearing).

Healthcare real estate

Another sector that is increasingly growing awareness is in the healthcare real estate arena.

We think this is a big growth sector – the listed health sector, for example, is the second largest REIT sector in the United States – however there are minimal listed healthcare asset owning vehicles in Australia.

With changes in human geography, an ageing population and demographics clearly showing that people are living longer in Australia, healthcare is a sector that is, and will, continue to be in demand. With consistent, non-cyclical levels of demand and attractive long term macro-economic trends, healthcare investments can provide attractive returns for lower levels of risk.

The healthcare property sector is also expected to grow in response to increasing demand for primary and secondary healthcare services, reflecting a Federal and State Government focus on preventative care as they seek to implement strategies aimed at reducing the overall costs of the healthcare system..

We are seeing very high-quality operators in this space, so when you do purchase healthcare real estate, you are getting strong operators and usually longer-term leases. Because they are investing so much into their tenancy, they want the longer lease, so it bodes well for an unlisted investment that can generate regular income as well as the potential for enhanced capital growth.

In this sector we currently have one unlisted fixed term fund open, for investment.

Open-ended unlisted property funds

Another way to access the property sector is through unlisted but open-ended investment vehicles. We have a hybrid model which is a diversified property fund. It has the benefits of unlisted investments, combined with some of the benefits of listed funds, whereby it’s a portfolio of properties, its always open, has daily unit pricing and a limited monthly redemption feature, so it does give investors some limited liquidity if they do wish to get out of the investment, which for some is an attractive option. Because we hold 20% in liquid products to allow for the redemptions it will return slightly lower yields (5-6%) compared to a closed ended 5-year unlisted asset, but still offering attractive returns.

Listed property investing

Put simply, Australian Real Estate Investment Trusts (A-REITs) pool the resources of investors together to buy a range of property assets, which the trust then manages for a profit. They generate most of their income through rent, with the lion’s share then returned to investors via distributions.

Centuria have two ASX listed sector specific A-REITS: an office A-REIT (ASX:CMA), with 20 high-quality office assets located around the country, and an industrial A-REIT (ASX:CIP), with 45 industrial/logistics buildings throughout the country. The benefits of these are that because they are sector specific A-REITs an investor can choose the sector they want exposure to.

An investor prioritising liquidity above yield in their ‘best of three’ approach, tend to be drawn to the listed property investments. Both Industrial and office property, A-REITs in particular, have seen significant changes across Australia over the years. Consumer behaviour, economic trends and changing expectations and priorities in people’s lives and work are really altering how fund managers select the right properties as part of their REIT portfolios.

Let’s look at these and what it means for investors today looking for sustainable income streams.

Commercial office real estate

Office real estate remains an attractive investment opportunity – but in a low-growth, low-rate world, knowing your tenants and their employees’ demands is key when selecting properties for your portfolio. In other words, returns, and particularly income returns from A-REITS are tied to tenant and asset quality – so understanding what tenants want, and giving it to them, is key to leasing success, and therefore, consistent income returns.

New research shows that the office space employers lease, plays a key role in employee satisfaction and retention. People are time precious in today’s work environment and prioritising a work/life balance has never been more important. So reduced commute times or seamless transport connections is key. Then upon arrival to work, end of trip facilities and well thought out office plans and technology are also critical to staff efficiencies and motivation in the office. Finally, having quality amenities close by enabling employees to complete their personal tasks more effectively help alleviate stress i.e. dry cleaners, day care facilities, supermarkets and dining now play a more critical role attracting the long-term reliable tenants.

Industrial/logistics real estate

Industrial property selection is also a sector undergoing significant change. The infrastructure investment boom, combined with the e-commerce thematic, manufacturing trends, and other developments, signals both change and good news for industrial real estate. What fund managers now look for in the ‘Shed’ space is rapidly changing. Reliable infrastructure is needed to connect supply chains, to move goods and services efficiently and to connect households to opportunities for employment, healthcare and education across cities and regions. Money spent on infrastructure powers industrial property.

Centuria have identified 5 key market movements that mater when selecting properties for an industrial portfolio. Infrastructure, Location, E-Commerce, Logistics and Manufacturing. Find out more about the significance of these themes in our recent Industrial Investing report here: How Australia’s 2020 infra peak will fuel industrial property

Office and Industrial sector specific A-REITS listed on the ASX can be great investments if you want direct exposure without being mixed into other asset classes. These two sectors both yield quite well in market compared to other listed entities, typically yielding at 5.5% to just under 6% .They can attract very high-quality tenants and, the big positive with listed REITs is the liquidity so you can gain commercial/industrial exposure, but also redeem easily and get your money back within a few days.

In summary

The Best of Three – Liquidity, Yield and the potential for Capital Growth: Can you achieve these through commercial property investing? We believe you can – When looking at your 2020 portfolio rebalancing, will 15-30% of property allocation increase for those that understand the property market? We think so, as property will play an important role for investors of all profiles in this lower for longer environment.

For further information on Centuria’s property offerings and to aid your clients in their property investing decisions visit centuria.com.au or speak to a member of our property team at: 02 8923 8923

Disclaimer

This was issued by Centuria Property Funds Limited (ABN 11 086 553 639, AFSL 231149) and Centuria Property Funds No. 2 Limited (ABN 38 133 363 185, AFSL 340304), wholly-owned subsidiaries of Centuria Capital Group (ASX: CNI). The information in this article is general information only and does not take into account the financial circumstances, needs or objectives of any person. Centuria is the responsible entity of a number of listed and unlisted property funds, each of which are issued under a product disclosure statement (PDS) that is available on Centuria’s website centuria.com.au for all funds open for investment. An investment in any of Centuria’s property funds carries risks associated with an investment in direct property including the loss of income and capital invested. The risks relating to an investment are detailed in each Fund’s PDS and Centuria strongly recommends that the PDS be downloaded and read before any investment decision is made. Centuria receives fees from investments in its property funds. Past performance is not a reliable indicator of future performance. CA-CPFL-21/11/19-001073.