Balmain deliver monthly income with online first mortgage investment

Promoted by Balmain.

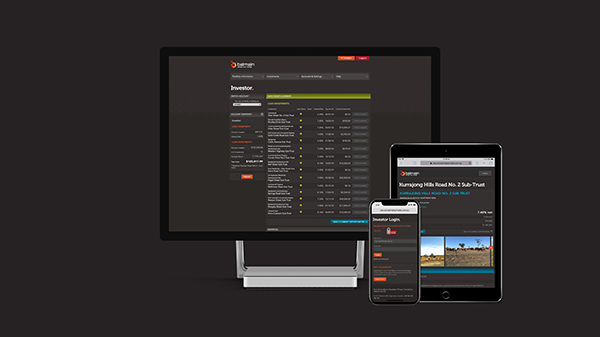

Balmain Private provides investors the ability to consider stand-alone investments in individual first mortgage loans via a unique online platform. You invest online, 24/7 at times and places which suit you.

You are able to build a commercial loan portfolio by investing in individual first mortgage loans of your choice backed by the loan management skills of Balmain, Australia’s largest non-bank commercial loan manager.

Initially you invest in Cash Units which are held in a cash management account with an Australian bank, currently the National Australia Bank (NAB).

Once invested in Cash Units, you have the ability to review in detail all of the underlying individual first mortgage investment Sub-Trusts, considering those that best meet your return, term and risk requirements.

All activities occur through your private Investor Control Console (ICC) which provides 24/7 transaction and reporting functionality.

You can move money from Cash Units to your bank account and vice versa, top-up and redeem your Cash Units, invest in Loan Units and track the progress of your investments easily and securely, all at the click of a button and once invested it is paperless.

Balmain Private regularly make available, for your selection, a range of first mortgage Sub-Trusts which Balmain have credit reviewed, fully funded and settled.

Discover more by visiting www.balmainprivate.com.au or ring the Balmain Private Investment Team on 02 9232 8888