Critical EOFY items flagged for SMSFs

With 30 June only a couple of weeks away, SMSF experts have outlined some of the important strategies and items to check off for SMSF clients before the end of the financial year.

Concessional contributions

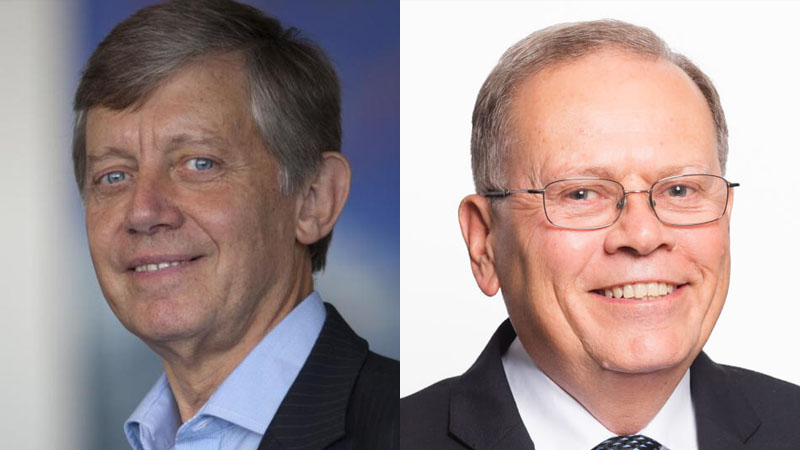

This is the first financial year where there’s an opportunity for clients to bring forward any unused concessional contributions that weren’t claimed last year and add them to this year’s standard amount, explained SuperConcepts executive manager, SMSF technical and private wealth, Graeme Colley.

“While most people have a standard concessional contribution cap of $25,000, if the total super balance on 30 June 2019 of less than $500,000, leftover concessional contributions that haven’t been used since 1 July 2018 can be added to the standard concessional contribution of $25,000,” Mr Colley said.

“But don’t forget, any contributions made by an employer or by salary sacrifice to an SMSF are counted towards the concessional contributions cap.”

If a tax deduction is going to be claimed for personal contributions to super, Mr Colley explained that an election must be made to the superannuation fund so it will be included in the fund’s taxable income.

“The fund is required to acknowledge the election and the person making the claim is required to give it to their tax adviser so the correct amount will be claimed as a tax deduction,” he said.

“The election is required to be given to the fund before lodgement of an individual’s income tax return, or at the end of the financial year after the contribution has been made, whichever happens first. However, should a person decide to roll over their super to another super fund to start a pension, the election must be made prior; otherwise, the deduction may be disallowed.”

For SMSF clients with an unusually high taxable income this year, SMSF Alliance principal David Busoli said SMSF professionals may want to consider a double contribution strategy.

“This will require an additional $25,000 to be contributed in June. Be cautious, as this strategy will utilise all next year’s contribution limit,” he explained.

Non-concessional contributions

Mr Busoli also pointed out that clients may want to consider making non-concessional contributions before the end of the financial year.

“The cap is $100,000 provided the member’s total super balance as at 30 June 2019 was less than $1.6 million (in all funds),” Mr Busoli said.

For clients wanting to make non-concessional contributions to their super this year, Mr Colley said this will depend on their age at the time of making the contribution as well as their total super balance on 30 June 2019.

“If a person is under the age of 65, the person may have the opportunity to bring forward the next two years’ standard non-concessional contribution of $100,000,” Mr Colley said.

“This means a person may be able to make a non-concessional contribution of up to $300,000 over a fixed three-year period commencing from the year in which a contribution greater than the standard non-concessional contribution has been made.”

Mr Colley stressed that the three-year bring-forward amount applies only if a person’s total super balance on super on 30 June 2019 is less than $1.4 million.

“If a person’s total super balance was between $1.4 million and $1.5 million, they would only be entitled to bring forward just one year’s standard non-concessional contribution,” he explained.

“If a person’s total super balance was between $1.4 and $1.5 million, the non-concessional contribution is limited to $100,000. It is not possible to make non-concessional contributions to a super fund with a total super balance of $1.6 million; otherwise, a tax penalty will apply.”

Ensuring the contribution can be accepted by the super fund

SMSF clients that are older than 65 this year and want to make personal contributions to super, will need to meet a work test of at least 40 hours over 30 consecutive days, at any time during that financial year, said Mr Colley.

"This applies for personal concessional and non-concessional contributions. In the year a person reaches the age of 65, there is no requirement to meet the work test if they wish to make contributions prior to the age of 65," he stated.

"There are exceptions to the work test that apply to personal contributions made in the year after a person ceases gainful employment, or where personal contributions are made for purposes of the downsizer contributions. Personal superannuation contributions cannot be made to a super fund 28 days after the month in which the person reaches the age of 75."

The only exception to the age of 75 limitation, he noted, is for downsizer contributions made after the age of 65, which must be made to the fund within 90 days after the sale of a person’s main residence.

"From 1 July 2020, the age for work test has been changed to the age of 67. This will allow anyone to make concessional and non-concessional contributions to super without meeting a work test up to the age of 67," he said.

Spouse contributions

Mr Colley also pointed out that if a spouse’s income is below the maximum $37,000 threshold and less than the age of 70, then their husband or wife may be eligible for a tax offset of up to $540 for non-concessional contributions they make on their spouse’s behalf.

"For each $1 of spouse contribution that is made, up to a maximum of $3,000, then a tax offset equal to 18 percent of the contribution is available," he said.

From 1 July 2020, the maximum age at which spouse contributions can be made to the fund is to increase to the age of 75. This means that a wife or husband can make non-concessional contributions for a spouse who meets the work test between the ages of 65 and 75.

Pensions

SMSF professionals should also ensure that clients receiving an account-based pension, including a transition to retirement pension, take at least the minimum payment amount by 30 June 2020.

"There can be significant taxation costs if they don’t – potentially as it could result in the earnings on all the assets supporting that pension will be taxed at the 15 per cent tax rate, rather than being completely tax exempt," said Mr Colley.

"The minimum payment is a percentage of a person’s pension account balance as at 1 July 2019, which has reduced by 50 per cent in March 2020, regardless of any changes in the account balance."

If a pension commenced during the year, Mr Colley said the minimum pension is pro-rata basis on the number of days remaining in the financial year.

"If a person’s account based or transition to retirement pension commenced on or after 1 June, the minimum pension is zero," he explained.

If an SMSF is paying a pension, Mr Colley warned that the required minimum pension payment should be made well before 30 June 2020.

"As an example, a person is of the age of 76 on 1 July 2019 and receiving a pension from their SMSF is required to withdraw a minimum pension equal to 3 percent of the 1 July 2019 balance," he explained.

"That is, if their pension balance at 1 July 2019 was $500,000, the minimum pension for 2019/20 was originally equal to 6 percent of the opening account balance ($30,000) but the account balance was reduced by 50 percent due to COVID-19 to 3 percent and is now $15,000."

Compliance and valuations

The end of the financial year is also a good time for reviewing the compliance of an SMSF and addressing any contraventions that may have occurred in the 2019/20 financial year, said Mr Colley.

"If there are any issues it is best to have them resolved before year end rather than get a knock on the door from the ATO auditor," he said.

It is also important to value the fund's assets as at 30 June 2020.

"While this may be a simple process for assets quoted at market price, like listed stocks and managed funds. If an SMSF has assets that are not on-market, such as real estate and collectables, it’s a good idea to line up the relevant assessors or valuers, where needed, early," he advised.

"External valuations may not be required every year, however, the superannuation law requires the trustee of an SMSF, to determine market value for each year’s annual financial statements."

Miranda Brownlee

Miranda Brownlee is the deputy editor of SMSF Adviser, which is the leading source of news, strategy and educational content for professionals working in the SMSF sector.

Since joining the team in 2014, Miranda has been responsible for breaking some of the biggest superannuation stories in Australia, and has reported extensively on technical strategy and legislative updates.

Miranda also has broad business and financial services reporting experience, having written for titles including Investor Daily, ifa and Accountants Daily.