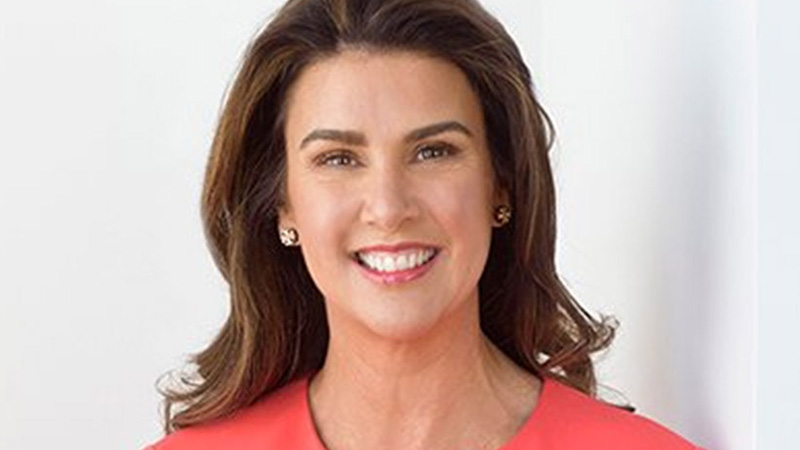

Senator Hume sheds light on disciplinary body reforms

Senator Jane Hume has outlined her expectations for the single disciplinary body, saying she wants to cut the “Gordian knot” of red tape and help advisers do what they do best.

Speaking to the AFA Vision Conference, the senator claimed the extension on the FASEA requirements as one of the biggest wins the government had delivered for financial advisers in 2020.

“There was a massive disconnect between what advisers were going through on the ground, and what FASEA were hearing… The fact that it required legislative change made me pull my hair out — this should have been something that was done with the stroke of a pen, and it wasn’t,” Ms Hume said.

But the creation of the single disciplinary body will be a “game changer” for an industry beset by sky-high compliance burdens and a multitude of regulators.

“It’s a huge opportunity. We want to make sure that there is a far better alignment of the regulatory requirements that are placed on you, and the legislative requirements as well,” Ms Hume said.

The body is set to be legislated in mid-2021 following delays and will “streamline and encourage greater professional discipline within the industry”.

“We know at the moment you have the Corporations Law, you’ve got a code of ethics, and then on top of that you’ve got the compliance that’s placed on you by your AFSLs,” Ms Hume said.

“I think that the combination of all of that makes things very difficult. The single disciplinary body makes it very clear what your obligations are and will align those regulatory burdens.”

Ms Hume also said she wanted to see a reduction in the number of institutions able to bring regulatory action against advisers.

“There are so many different organisations that can give you guys what I like to call an ‘involuntary colonoscopy’ at any point in time,” Ms Hume said.

“You spend so much time over-burdened by the compliance you need to do that you’re not actually doing what you’re best at. We’re hoping that the single disciplinary body will align some of those regulators so that there’s fewer of them and you have a clear path on what the performance standards are and that your peers will have a say.”