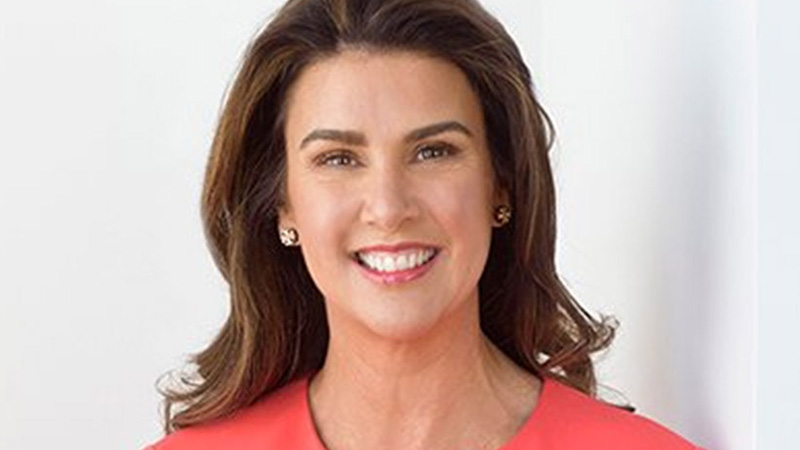

Jane Hume reaffirms commitment to fixing retirement advice regulation

Senator Jane Hume has assured the advice industry that improving access to affordable financial advice remains a priority for the Morrison government and has urged advisers to respond to ASIC’s consultation.

In a public update, Minister for Superannuation, Financial services and the Digital Economy, Jane Hume, said the Morrison government is committed to strengthening the advice sector and providing consumers access to adorable and high-quality advice.

“The government is focused on supporting the advice industry with fit-for-purpose regulation while maintaining consumer protections,” Ms Hume said.

“We know that some interpretations of current regulatory settings are creating barriers to consumers seeking good-quality, affordable personal advice. The government supports a well-regulated and vibrant financial advice sector that supports advisers seeking to help Australians make informed decisions about their personal finances and to make better use of their savings in retirement.”

Ms Hume noted that ASIC is currently undertaking a consultation on ways to improve consumer access to quality, affordable financial advice.

“The government encourages industry participants, stakeholders and consumers to submit feedback and recommendations before the close of the consultation period on Monday, 18 January 2021,” she said.

The Morrison government, she said, recognises that the financial advice sector is in a state of significant transformation.

“Not only is the sector going through the process of professionalisation, but the industry is also adapting and innovating in response to the challenges of COVID-19,” she said.

Ms Hume said the importance of access to financial advice was underlined for many during COVID-19.

“Good-quality, affordable financial advice was also recognised in the Retirement Income Review as being an important way Australians could maximise their income in retirement,” Ms Hume said.

An independent study released by ASIC found that almost one-third of Australians receive financial advice or have done so in the past.

“The study also found that 41 per cent of Australians intend to receive financial advice in the future; however, 20 per cent had considered seeking advice but had not gone ahead, with 35 per cent noting expense as the primary reason,” she noted.

“Already, the Morrison government has taken steps to professionalise the industry, reduce red tape, reinforce trust in advisers, and focus on a greater role for technology to help advisers access the tools they need. We now look forward to considering the outcomes of ASIC’s current consultation process.”

Miranda Brownlee

Miranda Brownlee is the deputy editor of SMSF Adviser, which is the leading source of news, strategy and educational content for professionals working in the SMSF sector.

Since joining the team in 2014, Miranda has been responsible for breaking some of the biggest superannuation stories in Australia, and has reported extensively on technical strategy and legislative updates.

Miranda also has broad business and financial services reporting experience, having written for titles including Investor Daily, ifa and Accountants Daily.