Take, for example, the case of a two-member, self-managed super fund where the couple has total assets worth approximately $13 million, and the benefits are split almost 50/50 between the husband and wife.

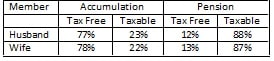

For each member, approximately half of their respective benefits are being used to pay an account-based pension, with the balance retained in the accumulation section of the fund. The following table sets out the tax-free and taxable parameters of each member’s accumulation and pension accounts:

With both members aged over 65, there is no tax on their pension, which is drawn at the minimum rate.

Initially, they started a pension with only part of their superannuation benefit, the minimum pension amount required to meet their needs. They were concerned about what would happen to the extra money they would be forced to take out of the fund if they started a pension with the rest of their respective benefits.

To provide context, if they had 100 per cent of their benefits paying a pension, they would have had excess minimum pension income of around $300,000 per annum.

However, the issue is not the excess income, but the impact of tax should both members pass away unexpectedly. They have adult children but no financial dependents, and the current taxable proportion of a death benefit would attract tax of approximately $1.1 million.

Given that the fund’s investment earnings in the accumulation part of their fund would be credited to taxable component each year, the potential death benefits tax would continue to grow over time. Based on a net earning rate of 8 per cent per annum, it is projected their death benefits tax liability could grow to around $2.7 million over the next 10 years. This would become a greater liability the longer they lived.

Creating an alternative strategy

An alternative strategy would be to start a second pension for each member of the SMSF.

The second pension would have approximately two thirds of the balance being tax free benefits, with the added advantage that this proportion would remain fixed for the life of the pension. In addition, their SMSF would no longer pay any income tax on its investment earnings, potentially saving approximately $56,000 per annum.

Locking in the tax-free/taxable proportion of benefits, and by having all benefits in pensions, means that future investment earnings of their fund would be credited to their pensions in the same proportion. If extra funds were required in the future to assist family, they could partially commute the pension with the higher taxable component.

Benefit to client

Upon implementation, the end result will be a $1.5 million reduction in the death benefits tax over the 10-year projection.

Gradually investing the excess pension income through their existing family trust and corporate structures will provide them the control and flexibility over their assets, as well as some taxation advantages.

In essence, with the tax rate on investment earnings capped at 30 per cent each year, the net benefit of the strategy is approximately $1.1 million.

Circumstances differ from client to client and life is unpredictable. The importance of developing individualised SMSF strategies for clients and taking the time to review is not to be understated.

By Chris Morcom, director and private client adviser at Hewison Private Wealth