Changes to how the ATO reviews ACRs mean that an SMSF does not automatically become non-compliant when an SMSF auditor lodges an ACR.

The most recent figures show the ATO made only 92 funds non-complying during 2014/15. With more than 556,000 SMSFs in existence and a 2.5 per cent ACR lodgement rate, that’s a 0.07 per cent chance a fund with a reportable breach will get taxed at the highest marginal rate.

Given these odds, it would appear that non-compliance is not in the best interests of the superannuation system. SMSF advisers should view non-compliance as a last resort punishment used by the ATO for hardcore, recalcitrant SMSF trustees.

How the ATO risk assesses ACRs

All ACRs are risk assessed by the ATO using risk models that analyse multiple indicators of non-compliance. This includes reviewing regulatory and income tax matters, drawing information from the SMSF annual return, ACRs and other data, such as trustee and members’ records.

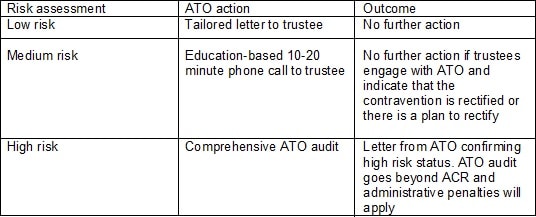

The ATO takes an educational approach when working with trustees who do the wrong thing, but will not hesitate to use their penalty powers when necessary. Typically, trustees will be contacted by the ATO within eight to 12 weeks of the ACR being lodged based on the fund’s risk assessment:

A low-risk ACR letter shouldn’t be interpreted by an SMSF adviser that the reported contravention is not important and doesn’t need to be rectified. Where the contravention remains unrectified in the next year or the fund contravenes the same section again, the ATO will risk assess it at the next level.

Medium-risk funds aren’t out of hot water either, as the ATO has stated that approximately 9 per cent of all medium-risk funds get moved up into the high-risk category. A sure-fire way of this happening is where a trustee, or their SMSF adviser, refuses to co-operate when contacted by the ATO.

This is to be avoided at all costs because once a fund gets to the high-risk stage, the ATO will put the SMSF under the microscope and look at every aspect of the fund that goes way beyond the ACR.

What should SMSF trustees do

SMSF trustees should not try to circumvent a breach by audit shopping for a better outcome when they don’t like the one from their SMSF auditor. Some SMSF trustees, or their SMSF adviser (yes – this has happened to SuperAuditors), are terminating the engagement prior to the auditor issuing their report.

It should be noted that SMSF auditors still have an obligation to report breaches even if they are no longer the fund’s auditor. They will lodge an ACR and advise the ATO that the audit was cancelled by the trustee (or their SMSF adviser) through Section G of the ACR. The ATO is aware of this and takes a very dim view about this type of behaviour.

It’s in the SMSF trustee’s best interests to fully co-operate with both the ATO and their SMSF auditor. This has never been more important as administrative penalties now range from $900 to $10,800 per SIS provision breach per trustee, which gets paid directly from the trustee’s hip pocket.

The benefit of a corporate trustee under these circumstances cannot be underestimated, as four individual trustees will be fined a whopping total of four x $10,800 = $43,200 for a breach of s 67(1) SIS as opposed to $10,800 for one corporate trustee.

Unfortunately, the evidence is that the majority of new funds in 2015 were set up with individual trustees and not a corporate trustee. Even putting the penalty issue aside, the administrative nightmare of having to replace an individual trustee in the event of death or a family fallout shouldn’t be underestimated. This can only be put down to false economy on the part of trustees.

How can SMSF auditors help

In the interests of streamlining reporting requirements, alleviating SMSF adviser concerns and reducing ATO information overload, SMSF auditors could be given a more proactive role in risk assessing ACRs.

Currently, SMSF auditors are required to apply seven tests to determine whether a breach is reportable. These have not been materially changed by the ATO since 2009.

The most outdated test is the financial threshold test, which states the SMSF auditor must lodge an ACR where the total value of all contraventions is greater than 5 per cent of fund assets or $30,000, whichever is the lesser.

With latest ATO statistics showing that SMSFs have average assets of $1,066,080, a breach worth $30,000 would represent 2.8 per cent of fund assets. This isn’t material – it’s simply a waste of everyone’s time and resources.

As the ATO has acknowledged that SMSF auditors act as a valuable gatekeeper for SMSF compliance, surely there’s more that could be done by SMSF auditors that could benefit the ATO, SMSF advisers and trustees?

Design new SMSF auditor ACR reporting tests

It would be more relevant to have a new set of practical tests designed in line with today’s SMSF landscape. As a start, the financial threshold test should be applied to a list of pre-defined high-risk breaches only.

For example, a first-time breach that is effectively an administration issue (such as incorrect account name) would not be subject to the financial threshold test. The fund would still be qualified, but no corresponding ACR lodged as r4.09A SIS could be classified as a low-risk breach.

Where it’s not rectified for next year’s audit, information regarding both years’ breaches would be reported at that time, thereby providing more insight into trustee behaviour.

Conversely, a high-risk s65 breach, where trustees illegally access funds to prop up their business, would result in a qualification with an ACR lodged as the financial threshold test would apply.

It’s important to ensure ACR reporting is easy to understand, transparent and manageable. There’s no benefit in having SMSF advisers uncertain about how the ATO will risk assesses a fund and what the outcome will be.

SMSF auditors can help demystify ACRs by assisting the ATO and SMSF advisers during the risk assessment process.

A review of the reporting criteria setting out what contraventions are reportable would be a solid start.

Shelley Banton, director, Superauditors