The hunt for yield

With interest rates at record lows and the cost of living rapidly rising, what are some of the options for SMSF trustees seeking higher levels of income?

Australian shares delivering around 9 per cent income sounds too good to be true. In this article, we take a look at a couple of professionally managed investment strategies that have been able to achieve this over the last five years.

With cash rates at 1.5 per cent and the Australian cost of living rising at a rapid pace, those requiring income from their investments face a dilemma. Should SMSF clients remain in cash and fixed interest and either burn capital, reduce their living standards due to the low rates or do they pursue higher income strategies elsewhere. According to the recent ATO statistics, the allocation of SMSFs to cash and fixed interest is 26 per cent.

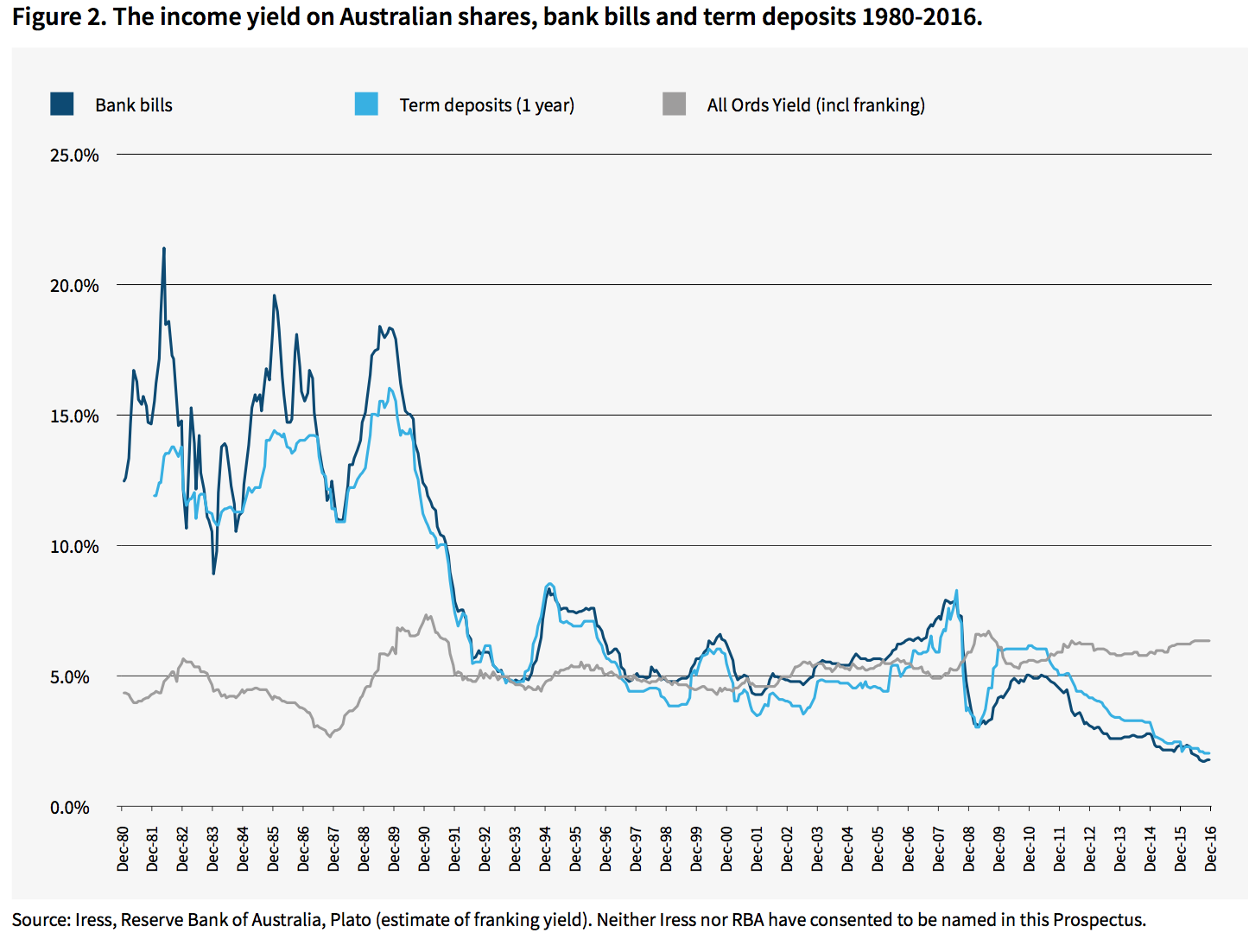

The Australian share market currently offers investors a higher income yield than cash, with potential for capital appreciation over time as can be seen in the chart below.

While the income yield from Australian shares is above 5 per cent per annum (including franking), some professionally managed funds employ strategies to enhance this yield for income-hungry investors.

Plato Investment Management is launching a listed investment company, which uses the strategy of the Plato Australian Shares Income Fund that has been in operation for more than five years. This fund is a long only fund (not using derivatives) that achieves higher income by buying securities on the ASX 300 in the lead-up to a dividend payment and selling once the dividend has been paid. Historical evidence shows that share prices tend to appreciate in the lead-up to a dividend payment, which the fund uses to boost returns. In the five years to 28 February 2017, this strategy returned income to investors of 9.1 per cent per annum with some capital appreciation.

Other high-income equity strategies focus on investing in high-income stocks, and then bolster income by writing call options over some of their holdings. A call option is an agreement that gives an investor the right, but not the obligation, to purchase a share at a specific price during a specific period in exchange for a financial payment. Many investment managers offer this style of high-income equity fund including Investors Mutual, Colonial First State and AMP, to name a few.

For example, an investor who owns 1,000 CBA shares could write a call option that would allow another investor to purchase their shares for a set price of say $90 (currently CBA trading at around $83) and in exchange for this agreement, receives a payment. This payment is considered additional income over and above the dividend that the investor receives. In the event that the CBA share price rose above $90, it is likely that the investor who wrote the call option initially would be obligated to sell the CBA holding for $90.

Therefore, it is important to understand that an investment strategy revolving around writing of call options carries the risk of limiting the upside when share prices rise. These strategies tend to outperform during flat or down market conditions and underperform during strong markets.

We are not criticising equity income strategies that use call options, we are merely making a comparison that demonstrates the limiting of upside. Below we have compared the Investors Mutual fund that use call options, to the Plato fund which does not. The figures are to the end of February 2017, sourced from company websites. Readers can see the limiting of upside returns in the strategy using call options over the last 12 months when the market has been positive.

|

Plato Aust Shares Income Fund |

1 Year |

3 Years pa |

5 Years pa |

|

Income |

9.6% |

9.1% |

9.1% |

|

Growth |

13.3% |

-0.2% |

4.7% |

|

Total Return |

22.9% |

8.9% |

13.8% |

|

Investors Mutual Equity Income Fund |

1 Year |

3 Years pa |

5 Years pa |

|

Income |

7.9% |

8.3% |

8.8% |

|

Growth |

6.9% |

1.7% |

3.3% |

|

Total Return |

14.8% |

10.0% |

12.1% |

Both of these managers are highly rated, so the purpose of the comparison is not to place one manager above the other, but to highlight the difference in strategies during a period of strong market returns, which is shown in the 12 month numbers.

We would also highlight that the soon to be listed, Plato Income Maximiser is a listed investment company, which is different to the other income funds which are available in the format of a unit trust. The benefit for SMSF trustees of investing in a listed investment company structure is the ability of the company to smooth dividend payments, where as a unit trust must pay out all income received to investors during the financial year in which it is received. This can result in income being somewhat ‘lumpy’.

Finally, the other difference between a listed investment company and a unit trust is that investors can purchase units in a trust by purchasing them directly from the investment manager, whereas a listed investment company must be purchased via the ASX or through an IPO.

Mark Draper, adviser, GEM Capital