Due to the lack of clear guidance and the importance of complying with the law in relation to the pension exemption, we examine the two methods for calculating ECPI in respect of account style pensions (i.e. account-based, allocated and market-linked pensions) under the Income Tax Assessment Act 1997 (Cth) (ITAA 1997) in the SMSF environment.

The main ECPI provisions are set out in ss295-385 and 295-390 of the ITAA 1997. These provisions provide the foundation for working out how much of the ordinary and statutory income of an SMSF (i.e. income other than assessable contributions and non-arm’s length income) is exempt from tax when the fund is paying a pension. (We generally refer to the term pension for simplicity as the correct tax term is superannuation income stream.)

Naturally, it is important to understand both the segregated and the unsegregated methods of calculating ECPI to ensure SMSFs are appropriately treated for tax purposes where one or more pensions are being paid. This understanding is also essential for compliance with the transitional CGT relief provisions. Unless the two ECPI methods are correctly understood, SMSFs may miss out entirely on CGT relief.

From 1 July 2017, a pension must be in retirement phase to obtain an ECPI exemption. A transition to retirement income stream (TRIS) will no longer be entitled to an ECPI exemption from 1 July 2017 as a TRIS will no longer be eligible to be in retirement phase.

Unsegregated method

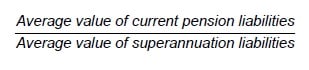

The unsegregated method is the most commonly used method for determining ECPI. Under this method, no particular SMSF assets have been set aside or identified as supporting pensions paid by the fund and the fund’s exemption is calculated using the following prescribed formula:

Where:

- The numerator (i.e. the top line above) averages the current value of pension liabilities in that financial year (this does not include liabilities for which segregated current pension assets are held); and

- The denominator (i.e. the bottom line above) averages the value of the fund’s current and future superannuation benefit liabilities (this does not include liabilities for which segregated current pension assets or segregated non-current assets are held).

Under the unsegregated method, an actuary must certify the exempt proportion of assessable income of the fund each financial year in accordance with the above formula.

In applying the formula, the actuary will broadly have regard to, among other things, the average balance, contributions, earnings and the days during a financial year that the average balances are held in the fund.

The unsegregated method does not require any special changes to a fund’s accounting system. There is generally an actuarial certificate and possibly some other supporting records such as trustee resolutions consistent with a fund using the unsegregated method.

Further, if an SMSF’s liabilities in respect of pensions during a financial were at all times (i.e. for the entire financial year ‘EFY’) liabilities in respect of superannuation income stream benefits that are account-style pensions, there is no requirement to obtain an actuarial certificate.

Some of the reasons for using the unsegregated method include:

- The record keeping requirements associated with this method are generally less onerous than for the segregated method. There may, therefore, be less administration and associated cost savings using this method (rather than the segregated method). This is by far the most popular method in practice;

- Capital losses are not lost, as they are under the segregated method; and

- The fund may be precluded from applying the segregated method from 1 July 2017 under the new rules (see below for further discussion of this restriction).

Segregated method

The segregated method is where the investments of a fund are allocated between assets that are being used solely to provide pensions (these assets are known as segregated current pension assets) and assets that are not in accumulation phase.

There are broadly two ways that ECPI segregation could apply:

- Active or actual segregation whereby certain fund assets are specifically set aside to fund current pension liabilities; or

- Deemed or de facto segregation whereby all of the assets of the fund are supporting current pension liabilities.

Active segregation is not that common and a considerable number of SMSFs are segregated as a result of being deemed segregated (i.e. 100 per cent of fund assets are funding pension liabilities).

Active segregation depends on appropriate record keeping. For example, it would be best practice to have:

- Trustee resolutions recording:

– The specific assets that have been specifically identified as funding the pension liabilities; or

– The specific assets that are not funding pension liabilities, e.g. an SMSF may have all of its assets funding a pension apart from certain assets that are not funding a pension. It may be easier to record the non-pension assets (e.g. cash in a separate bank account) rather than the pension assets which may be far more comprehensive (e.g. a diversified portfolio of investments); - Assuming less than 100 per cent of the fund is segregated – accounting records or computer systems that are set up to track the income/losses, capital gains/losses, tax entitlements and other aspects relating to the assets funding pensions (or as noted just above, the non-pension assets if this is easier); and

- Possibly other documentation which evidences segregation including a statement or letter of advice, financial statements, tax returns, a fund’s investment strategy etc.

As already noted, deemed segregation is possibly the more common form of ECPI segregation and there may not be any records evidencing this type of segregation. As discussed above, under active segregation, the fund’s accounting system needs to track the income/losses, capital gains/losses, tax entitlements and other aspects relating to the assets funding pensions. More specifically, the accounting system needs to be able to track not only the income/losses, changes in market values of assets, gross and net capital gains and franking offsets, foreign tax credits and other tax attributes of the fund’s segregated

assets.

In contrast, under deemed segregation, there is no specific tracking needed as 100 per cent of the fund’s assets are funding pension liabilities at that time.

Some of the reasons for using the segregated method may include:

- Can result in more efficient tax management of the tax exemption provided to income and capital gains from pension assets, e.g. an asset likely to give rise to a significant capital gain can be segregated and hence the gain can be realised tax free.

- Allocating investments to a member’s account may assist keeping separation of ‘who owns what’, e.g. some couples like to keep financial separation.

- There is no requirement for an actuarial certificate.

Can segregation be for part of a financial year or does it have to be for a full financial year?

We note, broadly, that there is no clear guidance from the ATO on this point. Certain ATO material suggests that deemed segregation requires a fund to be solely (i.e. 100 per cent) in pension phase for an EFY whereas other ATO material suggests that it can apply for part of a financial year (PFY). This has resulted in a general misunderstanding in the superannuation industry. We examine this issue below.

The following is a recent extract from the ATO’s website:

Where all SMSF fund members are receiving a pension, for the entire year of income and the combined account balances of these pensions is equal to the market value of the fund’s total assets, in effect all assets of the fund will meet the requirement of being ‘segregated’ as they have the sole purpose of paying super income stream benefits. In this situation, the ATO will accept that the SMSF is not required to identify individual assets as being dedicated to funding a super income stream benefit. You will not need to obtain an actuarial certificate to claim ECPI if:

- You want to claim the tax exemption using the segregated assets method, the assets were segregated for the entire year of income; and

- At all times the pensions were payable during the income year, the SMSF only paid allocated pensions, market-linked pensions or account-based pensions, and no other type of pension.

We note that s 295-385(3) of the ITAA 1997 appears to recognise that assets can be segregated assets for a PFY as the provision states “at a time assets are solely funding pensions…” provided an actuarial certificate is obtained.

In contrast, s295-385(4) broadly provides that segregated assets supporting account style pensions for an EFY do not require an actuarial certificate provided sub-ss295-385(5) and (6). This is not inconsistent with the ATO’s comments in TD 2014/7 at [41] to [42] but the ATO do not expressly confirm that PFY segregation is available in TD 2014/7 nor in the above ATO website extract. Thus, s295-385(3) does support PFY segregation on a legal analysis.

Note, at the risk of oversimplifying actuarial science, given the formula under the unsegregated method above excludes segregated assets (both in the numerator and the denominator; the denominator excludes both segregated current pension assets and segregated non-current assets), there may be no significant impact on the exempt proportion that is derived from the application of the unsegregated formula.

Example: a segregated fund that needs an actuarial certificate

The Charlie Super Fund is entirely (100 per cent) in accumulation for the first four months of a financial year. Charlie is the sole member of the fund which has $1.65 million in accumulation.

Charlie, however, decided to commence a pension on 1 November 2016 so he would be entirely (100 per cent) in pension mode for the remainder of FY2017.

The segregated CGT relief applies where an asset in the fund was segregated on 9 November 2016. This is the case as the fund was deemed to be segregated on that date under the ATO view that all (i.e. 100 per cent) of the fund’s assets were supporting pension liabilities that that time.

It is interesting to note that, while an actuarial certificate is required for FY2017 in accordance with s295- 385(3), the fund remains segregated from 1 November 2016 for the remainder of FY2017 (provided the fund remains 100 per cent in pension mode and does not, for instance, receive a contribution, rollover or create a reserve account).

The segregated ECPI exemption still appears to apply. This because, as discussed above, the unsegregated ECPI formula excludes segregated assets from the formula (from both the numerator and the denominator). However, since an actuarial certificate is required, many may be led into the trap that the unsegregated CGT relief applies since there is an amount of unsegregated ECPI. In particular, the proportionate CGT relief provision, s294-115(1)(b) of the Income Tax (Transitional Provisions) Act 1997 (Cth), being one criterion of proportionate CGT relief applying, provides:

The proportion mentioned in subsection 295-390(3) of the Income Tax Assessment Act 1997 in respect of the fund for the 2016-17 income year is greater than nil.

Thus, this complexity may well result in SMSF trustees and their advisers choosing the wrong CGT relief method. This is a complex and technical area of the law that involves actuarial expertise and in our opinion, needs urgent attention.

Naturally, if you do need to decide soon, expert tax, actuarial, financial product, accounting, legal and commercial advice should be obtained (we are not joking as this CGT relief is so complex) before a choice is made so an adviser will not be subject to future legal action for advising on a choice that may require all these skill sets.

Furthermore, unless this point is clarified soon, some SMSFs may potentially miss out on CGT relief altogether.

However, since there is no clear ATO view on some of the above points, and since we are aware of different views from different advisers, we have asked the ATO for clarification.

Changes from 1 July 2017

From 1 July 2017, both methods of ECPI will be subject to the new requirement that the relevant pension is in retirement phase. TRISs are expressly excluded from being in retirement phase. Accordingly, account-based pensions will be tested for the transfer balance cap, but not TRISs.

Additionally, certain SMSFs and small APRA funds will be precluded from using the segregated method to determine their exempt income from 1 July 2017. This restriction will apply to an SMSF where a member of the fund has a superannuation interest in tax-free retirement phase and a total superannuation balance in excess of $1.6 million. Note that s295-387(c) expressly states that the total superannuation balance threshold is $1.6 million rather than the general transfer balance cap, so this $1.6 million threshold is not indexed.

Transitional CGT relief

Although it is beyond the scope of this article to examine the transitional CGT relief provisions in detail, it is worth noting that the relevant provisions in Sub-Division 294-B of the Income Tax (Transitional Provisions) Act 1997 (Cth) refer back to the ECPI provisions.

However, in contrast to the EFY approach to ECPI discussed above, these provisions broadly work on a point in time basis for the purposes of the pre-commencement period which is 9 November 2016 to just before 1 July 2017.

Accordingly, funds that were 100 per cent in pension phase on 9 November (including funds with members in TRIS phase prior to 1 July 2017) are deemed to be segregated at the relevant time and are potentially eligible for the segregated CGT relief that applies to SMSFs which are under the segregated ECPI method. If the segregated CGT relief applies, a cost base reset occurs for elected assets at the time that the relevant asset ceases to be a segregated current pension asset of the fund and any notional capital gain is fully disregarded.

In contrast, funds using the unsegregated method will potentially be eligible for the proportionate CGT relief that applies to SMSFs using the unsegregated method. If this relief is enlivened, the fund will need to account for the non-exempt portion of any notional capital gain on any elected assets in its FY2017 tax return or opt to defer this notional capital gain indefinitely until such time as the relevant asset is disposed of by the SMSF trustee.

Transitional CGT relief – needs revising

SMSFs that were segregated on 9 November 2016 must ensure an asset ceases to be a segregated current pension asset prior to 1 July 2017.

Typically, this is evidenced by a trustee resolution and where a commutation is involved, the ATO in Practical Compliance Guideline (PCG) 2017/5 has confirmed that a commutation can be documented even though the value of the member’s superannuation interests are not available on 30 June 2017 subject to a number of qualifications. DBA Lawyers commutation documents satisfies PCG 2017/5.

This pre-1 July deadline for an asset to cease to be segregated applies despite an SMSF having till the lodgement date of its FY2017 tax return to complete the choice in the approved form. (We still await the ATO to issue this approved form.)

Interestingly, despite the uncertainty above relating to when an SMSF is segregated, the segregated CGT relief hinges on whether an asset was a segregated current pension asset at a particular time, i.e. at 9 November 2016. As you may appreciate, this ‘point in time’ segregation adds another layer of complexity to the uncertainty raised above in relation to PFY and EFY segregation.

Furthermore, the explanatory memorandum to the Bill that became the Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016 (Cth) and the ATO’s comments in LCG 2016/8 on part IVA of the Income Tax Assessment Act 1936 (Cth) relating to the general (tax) anti-avoidance provisions is making the application of the relief more difficult in practice and further guidance on what is possible without being subject to the general anti-avoidance provisions is required to ensure there is greater certainty in applying the CGT relief provisions.

The above ingredients have the potential for the making of a ‘perfect storm’ whereby many SMSF trustees will lose out unless they correctly apply the CGT relief within the prescribed deadlines.

We, therefore, recommend the CGT relief provisions be simplified and further time be permitted to comply with them. The CGT provisions combine, among other things, complex legal, tax, actuarial and superannuation rules, and the time and complexity of getting a sound understanding of these rules, let alone implementing the CGT relief appropriately and on time is an extremely difficult task even for SMSF experts. Moreover, SMSFs will incur considerable costs in seeking advice. Indeed, many SMSFs will be dissuaded from making a choice due to the complexity and costs involved.

The old saying that “the law is an ass” appears to apply here. That is, the law, as created by legislators or as administered by the justice system, cannot be relied upon to be sensible or fair.

Conclusions

Understanding the ECPI provisions is critical to ensure that SMSF assets are appropriately exempted from tax where one or more pensions are being paid, and for compliance with the major superannuation reforms.

We consider that an SMSF can be segregated for PFY and unsegregated for the remaining PFY. However, there is no clear ATO view on this issue and some consider that an SMSF that is purportedly segregated for PFY must apply the unsegregated method for the whole FY. Accordingly, there is a need for clarification on this important point.

Further, the segregated CGT relief is in need of revision to enable SMSFs to obtain clarity and obtain advice on how to implement the relief once clarity is provided.

William Fettes, senior associate and Daniel Butler, director, DBA Lawyers