Safeguarding SMSF portfolios through market cycles

There’s been a marked uptick in commentary about market cycles, market pricing and the risk of correction. Pricing and valuations are heightened across many asset classes, bringing into play the threat of downside risk. Given this scenario, how can SMSF portfolios be best positioned to withstand the impact of a downturn?

One aspect given little airtime is the impact investment structure can have on investment performance.

The liquidity conundrum and the rise of ETFs

Many investment commentators wax lyrical about the need for liquidity; that is, the ability for investors to enter and exit an investment when required. Liquidity is a big selling point for ETFs, an investment vehicle that’s become particularly popular with SMSF investors.

In fact, according to the seventh annual BetaShares/Investment Trends ETF Report published in April 2018, SMSFs comprise 33 per cent of ETF investors. Since 2010, just after the GFC, the number of SMSF investors using ETFs has grown a staggering 288 per cent.

Without doubt, liquidity and the ‘easy’ strategy of picking an index as opposed to specific stocks has contributed to the enormous growth of ETFs. However, just as the ETFs have risen in value off the back of their own momentum, what happens when the pendulum swings the other way?

Liquid markets rely on rational investor behaviour to operate efficiently. However, as history has proven innumerable times, investor behaviour becomes irrational in falling markets and thus, market movements are magnified.

The liquidity and structure of ETFs amplifies this even further, much in the way gearing affects an investment outcome. This is something that needs to be considered when assessing a portfolio for risk.

Illiquid investment structures

In property, which is Forza’s area of expertise, there exists the luxury of having well established, well informed listed (liquid) and unlisted markets. As such, property is an exemplar for illustrating how a different investment structure can result in materially different outcomes.

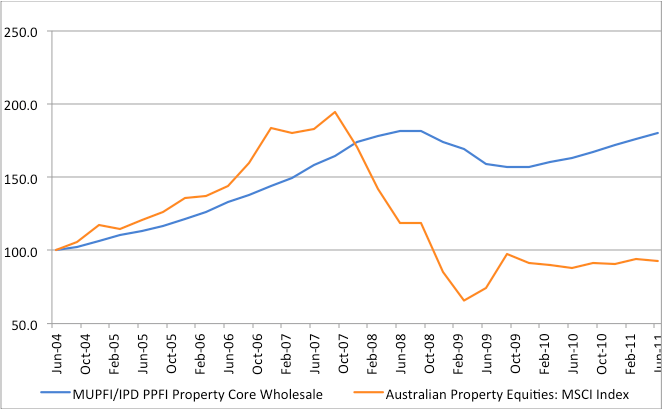

Figure one illustrates the returns from listed property and unlisted (core) property for the three years pre and post the GFC; as such, it’s a strong representation of the impact of a downturn.

Source: MSCI

As shown in figure one, peak to trough during the GFC, listed property lost ~66 per cent of its value; on the other hand, unlisted property declined ~14 per cent. While the underlying asset class is the same, there is a manifest difference in the resultant investment outcomes. Why? Investment structure.

This is not to suggest there were no investment disasters in unlisted property during the GFC. Plenty of capital was lost and a number of funds were “locked up” so investors could not withdraw capital. These were clearly not good outcomes however, over the entire sector, the unlisted property sector rode out the GFC much better than its listed counterpart.

In support of this is the following statistic: for a traditional 60/40 portfolio (60 growth/40 defensive), 90 per cent of portfolio volatility comes from the 60 per cent allocation to growth investments, most of which are listed securities.

Five tips to protect SMSF portfolios from risk

Given this, and some of the cyclical headwinds the market is facing, the following factors should be considered when reviewing SMSF portfolios.

- Understand the impact of structure

As previously outlined, the investment structure can impact pricing. Unlisted assets can generally ride out volatile markets, provided the other attributes of the investment are sound. HNW investors typically have a higher allocation to unlisted assets for this very reason. Given SMSF investors generally don’t require ready access to their capital, the lack of liquidity can reduce portfolio risk.

- Do your investment homework

Notwithstanding point one, an investment is ultimately only as good as the underlying asset(s). As with all investments you recommend to SMSF investors, take the time to understand the investment, be prepared to ask the tough questions of managers and review all accessible research. Discuss opportunities with your network and ask people who might know more than you for their views. Collective intelligence can be a very powerful thing.

- Understand the margin of error

Is the investment strategy high risk? What are the various exit strategies? Does the asset carry gearing and if so to what level does asset pricing need to soften before covenants are breached?

By understanding the responses to these questions, you can form a view about the sensitivity of an investment to risk and capital loss. This will help you determine whether the return being offered is commensurate for the risk, as well as understand the probability of capital loss.

Importantly, it allows you to have the conversation with your clients about investment risk, capital loss and the potential impacts each investment can have on an SMSF portfolio.

- Research the investment provider

The ASIC mandated performance warning says “past performance is not a reliable indicator of future performance” but it’s often a good place to start.

How has an investment provider performed? Is outperformance sustained over a reasonable time period or a ‘once off’? Has the manager outperformed the market and/or its peers, and what level of risk has been taken on to achieve this? How is risk managed?

In every asset class there are investment managers who deliver strong outperformance for sustained periods. Learn why and how they do it. Be sure to ask any investment provider you are considering these questions and again, use the collective intelligence of your network to find out who the perceived good operators are.

Encourage your clients to read about the investment managers and products you recommend; the better they understand both, the more comfortable they will be during challenging times.

- Consider fees

Fees are an oft overlooked, but very important, component of investor returns. What fees are charged and what proportion is risk free; that is, not tied to investment performance?

Good managers are willing to back themselves and both charge fees based on performance and invest equity alongside their clients. This helps to align thinking and outcomes and should provide your clients with a vote of confidence that the manager will always act in the investors’ best interests.

Historically, bull markets don’t run forever – and fortunately, neither do bear markets. However, a lot of damage can be done to a portfolio during a downturn, so being prepared is the best defence.

Adam Murchie, director, Forza Capital