Diversifying SMSF portfolios in today's market

Is a split between growth and defensive assets still enough for SMSF portfolios to achieve diversification in the current economic environment?

One of the key assumptions in modern model portfolio theories is that diversification lies on the basis of increased portfolio returns. The purpose of this article is to explore the little diversification that still exists in portfolios and what else there is left.

Defensive assets

For investors that want security and certainty, the best way to invest remains to be in defensive assets, be it in bonds or fixed income. As defensive assets provide less riskiness, the nature of the risk-reward paradigm concludes therefore lower returns. With cash returning currently around 2.5-3 per cent based on current RBA interest rates of 1.5 per cent and expected to last beyond 2018, and domestic government bonds around 3.15 per cent (10 years), it’s all not too exciting but extremely risk-averse and therefore excellent for mortgage-holders who don’t want to run into liquidity shortages.

Beside these safe options and on the outer end of the defensive asset space, investors can jump into riskier bonds, such as high yield or EM bonds, who will generate higher returns but include higher volatility. Even more, convertible bonds and all other sorts of exotic abbreviations such as CoCos, etc. are most risky and could potentially behave more abruptly than some of the growth assets discussed below.

Growth assets

Within the growth assets space, most well-know assets are equities or stocks, having returns that could go either way of the spectrum, positively or negatively. Even though we would often forget both ends still exist because of the sustained growth period we find ourselves in since the GFC, the key determinant of its pricing is a combination of valuation, momentum and growth potential (resp. value, cyclical and growth stocks).

With valuations at all-time highs based on PE ratios, the quest for reaching cyclical tops is imminent and lesser growth, or even losses, are expected over the short to medium term to occur. A typical event that would trigger this, referred to as a black swan, could be as far as one day or 5 years away, which is not the topic of this article.

Historical PE ratios in Developed Markets (Australia, US and Europe

Very typically, when bond markets go up, equity markets have the tendency to do the reverse. Triggered by an interest rate hike or other quantitative tightening, defensive and growth assets typically move in opposite direction and therefore showcase negative or little correlation.

So far, a method of diversification that still works in today’s markets between defensive vs growth assets.

Sub-asset class diversification

Domestic equities

The home bias of Australian investors, spurred by franking credits, is probably one of the most detrimental prodigies to diversification that has established itself in today’s investment portfolios and therefore superannuation.

Understanding the domestic economy and respective companies is one thing; endlessly supporting them for the sake of tax benefits is another. Because, even how patriotic one belief in one’s economy, for an open economy such as the Australian one, there’s an enormous influence of external news and factors that could shift our economy immediately. And this even disregards any political risks or legislative changes due to the Royal Commission.

Global equities

So, this leads us to whether diversification within global equities could save portfolios from potential downfall? As we are very keen on believing in growth opportunities within Asia, US or Europe, again this accounts for one of the most inherent misconceptions, i.e. diversification within sub-asset classes protects against losses.

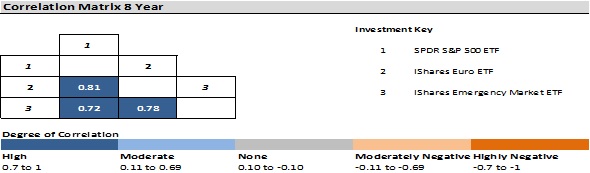

Due to the growth of ETFs worldwide, more and more diversification efforts within asset classes include just following the major indices around the world, be it S&P500, EuroStoxx 600 or the Emerging Market index. However, between these indices still exist large correlations, as we see below, due to the increase of global news spread increasingly faster around the world.

Correlation matrix between most used global ETFs

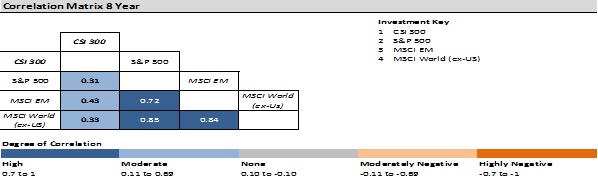

With all mainstream equity classes being much more correlated and most economies almost in the same cyclical phase, the search for atypical stock markets is on the rise. A decorrelated stock market like China A-shares may be one of interest (indicated by the CSI300 index).

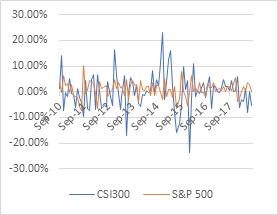

Currently not in favour because of the divergence of monthly returns between the S&P500 and the CSI300 (see graph), the correlation between the A-shares market and other indices is lowest of all and provides therefore excellent diversification.

Monthly returns (S&P500 and CSI300)

Correlation matrix between CSI300 and other global indices (2010-2018)

With new markets opening up to the world, there are new opportunities that may not be understood at first. And for the better, it is giving investors new opportunities and potential for diversification with the aim of risk mitigation and outperformance. Even though PE ratios don’t give you the complete picture, it allows you a different valuation perspective than the ones we’ve seen previously.

Historical PE ratio comparison (2010-2018)

As the China A-shares market doesn’t allow direct investments from overseas retail investors, it pleads the case of active management as a way of investing with knowledge instead of following mainstream inflows into a passively created index.

Alternatives

The remaining asset class that could provide investors with some ascertained diversification would be the alternative space. With sub-assets ranging from hedge funds to REITS (Real Estate Investment Trusts) and commodities to currencies.

Being perceived as one of the highest risk asset classes, it’s also probably the least understood. As it can contain different financial instruments, such as hedging, shorting and can make use of a diverse range of derivatives, such as options and futures, there’s more risk involved than any other asset class. But as these asset classes can provide greater diversification, it’s probably worth the effort for investors getting more acquainted with this type of asset class.

Conclusion

Overall, obtaining that much wanted diversification is still being achieved by splitting growth from defensive assets. Going into each sub-asset, investing into unknown markets or asset classes is still best to be executed with expert knowledge. Even if ETFs provide you less costly exposure, active management allows you to make lesser mistakes and therefore experiencing fewer growth spurts whereas passive management can still be used for established stock markets that provide higher market efficiencies.

Stan Segers, business development manager, Inno Quantum Capital Management