This article covers account-style pensions such as account-based pensions and transition to retirement income streams (TRIS) that are in retirement phase. A TRIS is in retirement phase where a member has satisfied a relevant condition of release and the other criteria in s 307-80 of the Income Tax Assessment Act 1997 (Cth).

The TBC rules are very complex and can result in extra tax being raised even from inadvertent oversights. Thus, expert advice should be obtained where there is any doubt.

TBC

Broadly, the TBC is a lifetime cap of $1.6 million that a member can transfer into retirement (i.e., tax-free) pension phase. Treasury suggested that the TBC rules would impact less than 1 per cent of superannuation fund members in mid-2017. However, all funds must have the capability of monitoring and managing the TBC for each member.

The transfer balance account (TBA) is a ledger that tracks credits transferred into retirement phase and debits that are commuted from retirement phase. The net account balance of the TBA is called the ‘transfer balance’ (i.e., total credits minus total debits). Importantly, credit and debit amounts are fixed at the time they are recorded in the TBA. Moreover, investment gains and losses and pension payments do not impact a member’s TBA.

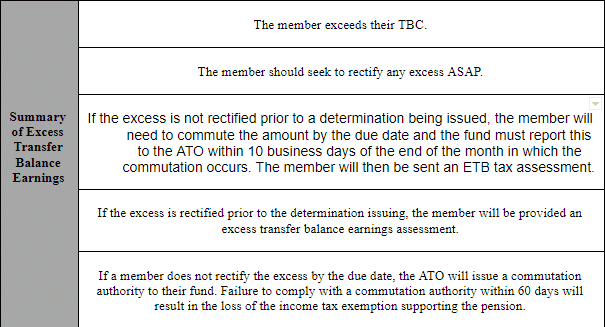

A member can rectify an excess transfer balance by commuting an appropriate amount of their pension(s) (together with any excess transfer earnings thereon) to eliminate an excess transfer balance.

A common issue identified by the ATO where people exceed their TBC is when an SMSF member commutes their pension in their SMSF (e.g., a $1 million pension) and then rolls their benefit to an industry or retail superannuation fund to commence a new pension. Large funds report TBA events no later than 10 business days after they occur. Thus, the member has a credit for the pension they started in their SMSF (e.g., $1 million) and they also obtain a credit from starting their new pension in the large fund (e.g., $1 million). Since SMSFs typically report on an annual or quarterly basis, the member’s TBA may not reflect the debit from the commutation in the SMSF and the member therefore still has two credits (e.g., 2 x $1 million giving a balance of $2m with a $400,000 excess) giving rise to excess transfer balance earnings. However, SMSFs can report TBA events prior to their prescribed annual or quarterly deadlines and are encouraged to do so to minimise these types of issues.

Where an excess results from a reporting error by the superannuation fund, the trustee of that fund needs to lodge a TBA report to cancel the incorrect information and provide the correct information as soon as possible to the ATO.

Excess transfer balance earnings

A member with an excess transfer balance is deemed to derive notional earnings on the relevant excess amount that is subject to ETB Tax which is payable by the member.

Notional earnings accrue on a member’s excess transfer balance based on the general interest charge (‘GIC’; currently 7.10% for the quarter of 1 July 2020 to 30 September 2020). These notional earnings compound daily — eg, each day a member has an excess, notional earnings accrue on the excess amount.

Notional earnings on the excess amount cease being credited to the member’s TBA when the ATO issues an excess transfer balance determination or the member ceases to have an excess transfer balance, whichever occurs first. This allows the ATO’s determination to confirm a fixed amount to be commuted from the member’s retirement phase (ie, the amount of the excess plus the amount of notional earnings confirmed in the determination).

While excess transfer balance earnings accrued after a determination issues are not reflected in a member’s TBA, the member remains liable for ETB Tax on notional earnings until they commute the excess amount.

If a member rectifies an excess transfer balance before the ATO issues a determination, they should also calculate the notional earnings on the excess amount that needs to be commuted from their retirement phase pension. Timely action by the member in commuting any excess (including any notional earnings thereon) minimises any ETB Tax. By taking timely rectification action before a determination issues allows the ATO to issue an excess transfer balance tax assessment (instead of issuing a determination).

Where a member does not commute the amount of the excess amount in time, the ATO will issue a determination to the member. Broadly, this determination specifies the amount to be commuted (ie, ‘crystallised reduction amount’) and a default commutation notice is also issued that specifies the relevant fund(s) and pension(s) that the ATO will send a commutation authority to. This is unless the individual commutes the crystallised reduction amount themselves by the due date or makes an election for the ATO to send commutation authorities to a different fund or account to that are set out in the default commutation notice.

A member who chooses to make an election instead must do so within 60 days of the determination and will generally pay more excess transfer balance tax than if they acted themselves, because it will take longer for the crystallised reduction amount to be commuted. The SMSF must report the commutation to the ATO no later than 10 business days after the end of the month in which the commutation occurs. If they do not do so, there is a risk the ATO will issue a commutation authority to their fund and the amount may be commuted twice.

If an SMSF receives a commutation authority, they must commute the specified amount from the specified income stream and report this to the ATO by the due date.

An SMSF trustee should generally make reasonable efforts to consult with the member on whether they would like the excess amount to remain within the superannuation fund in their accumulation account or whether it should be paid out of the superannuation system as a lump sum benefit. If the trustee cannot determine the member’s wishes in time to comply with the commutation authority, they will need to act in the member’s best interests.

Failure to comply with a commutation authority within 60 days can result in the pension ceasing to be in the retirement phase. This will result in the pension ceasing to qualify for a pension exemption from the start of the relevant financial year in which the fund failed to comply with the commutation authority and all later financial years. Since that pension is deemed to have ceased, a debit to that member’s TBA applies for the capital supporting that pension at the end of the commutation authority period. SMSFs do not need to lodge a TBA report for this type of debit, as the ATO contacts the trustee to obtain this information.

Naturally, SMSF trustees should act in a timely manner to minimise any risk of a member’s pension ceasing to be in the retirement phase and the adverse follow on consequences flowing from a compulsory commutation notice. These adverse consequences require further adjustment to the member’s TBA, loss of the pension exemption, and the requirement to commence a new pension if they wish to start a new pension within the member’s remaining TBC.

ETB Tax

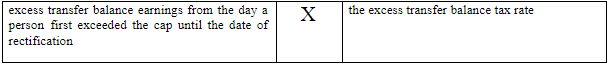

Once the excess amount and excess transfer balance earnings have been removed from retirement phase, the ATO will calculate the amount of ETB Tax that is payable. Broadly this tax is based on (as adjusted for days the member is in excess and the relevant interest rate, etc):

Note that notional earning on the excess transfer balance accrue until the excess position is fully rectified. In contrast, the amount of notional earnings credited to the member’s TBA is the amount stated in the ATO’s determination.

The ETB Tax (ie, the tax rate on notional earnings) is 15% for excess transfer balances for first time offenders. However, a 30 per cent tax rate applies for subsequent breaches (see s 5 of the Superannuation (Excess Transfer Balance Tax) Imposition Act 2016 (Cth)). This tax is a personal liability of the relevant member.

Given a member generally has satisfied a condition of release on commencing a pension in retirement phase, they can access the commuted amount if they wish to pay any ETB Tax from those funds.

ETB Tax is due and payable 21 days after an assessment is issued and the general interest charge (GIC) accrues on any late payment. A member who is dissatisfied with a determination can object under the standard objection regime for taxation matters under Part IVC of the Tax Administration Act 1953 (Cth).

MLPs and other pensions

ETB Tax is not imposed for a breach of the TBC that is wholly attributable to capped defined benefit income streams as these pensions are subject to special income tax rules.

Further, there have been recent changes to the TBC rules in respect of market linked pensions (MLP) that commenced before 1 July 2017.

The TBC provisions relating to these pensions are too complex to summarise here and expert advice should be obtained.

Conclusions

Careful ongoing management is needed for those getting close to using their entire TBC.

Daniel Butler, director, DBA Lawyers

***Editor’s note**** This article has been amended since original publication to ensure the accuracy of the information following input from the ATO