Bad news as inflation unsettles markets

With the investment landscape facing a raft of issues, equity exposures should be focused on companies with strong balance sheets and cash flows.

Key issues impacting the investment landscape include the pandemic which continues to complicate activity, inflation which may stay surprisingly high for an extended period, interest rate hikes which will likely weaken economies next year and recession risks which are weighing on certainty and sentiment.

Global activity is set for meaningful slowdown in the next eighteen months. How deep recession will be remains an open question dependent on the timing and quantum of rate hikes. The hardest hit will be those with large debt balances and high exposure to the various other cost pressures. By and large however, household and corporate balance sheets are in reasonable shape, and this makes it more likely that the downturn will be shallow.

The United States has just cycled two quarters of negative GDP growth putting it in technical recession. However, stubbornly strong underlying economic momentum and inflationary pressures during the remainder of this year are likely to encourage the US Federal Reserve to tighten monetary policy by more than markets are hoping. Demand is likely to be drained significantly next year, particularly as employment markets soften.

US rates are likely to be raised until underlying inflation falls below the official cash rate. Underlying inflation will fade but may be well above 3% through 2023, highlighting that the cash rate currently at 2.5% appears far too low. These moves will probably necessitate higher unemployment and further weakness in housing. Rates could be lifted above 4.00% in the next 6-12 months, but the market is pricing in merely 2.75-3.00%. Resolution of this discrepancy is likely to be a source of market volatility.

European recession is likely to hit sooner than in the US given the dependence on Russian energy. Chinese growth is weakened by intermittent lockdowns and property sector troubles.

Global purchase manager index (PMI) data is trending lower for both manufacturing and services while remaining above the mark of 50 indicating expansion. Consumer confidence has plummeted with heightened inflation and lower real incomes.

Weakening housing markets reflect the speed to which affordability troubles impact demand. Discretionary goods demand is softening, partially offset by the rise in travel, entertainment and other services as virus health fears recede. In turn, metals prices, supply chain bottlenecks and shipping costs from China have eased.

Inflation above pre-pandemic levels

Surging inflationary pressures are peaking at the headline level. However, for an extended period stubborn elements are likely to keep underlying price increases, excluding energy and food, above levels that central banks are comfortable with. The US Federal Reserve and other central banks may be encouraged to tighten policy more than many market participants are hoping. US underlying inflation is likely to quickly fall from current levels near 6% but could still be well above 3% by the end of next year.

The initial jump in prices post the pandemic was due to goods demand exceeding supply constrained by factory shutdowns and logistics complications. Now both supply and demand are adjusting. Savings built up during the pandemic are being rapidly used up and consumers are becoming more price conscious as sentiment declines. Order backlogs are starting to clear and inventory levels have recovered.

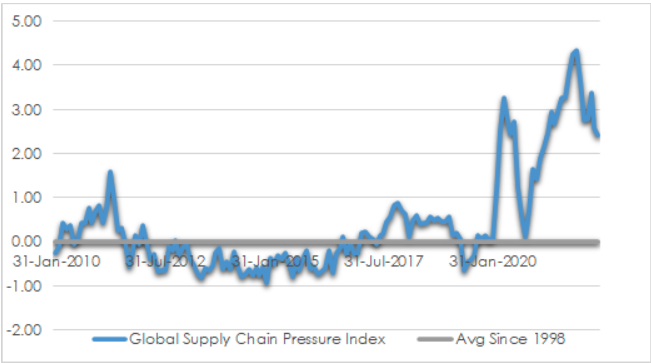

The New York Federal Reserve’s Supply Chain Pressure Index indicates marked improvement in the past few months but still far from normal. Covid-19 continues to constrain activity and add to inflation even though much of the world has resumed normal behaviours following prior lockdowns to control case numbers and serious illness. The virus remains a disruptor in daily life, prompting last minute changes to plans, isolation and avoidance of activities that present high risk of spread. China’s strict containment policies postpone more wholehearted reopening in that country to next year. The additional complexity in managing organisations is reflected in ongoing troubles in the supply chain.

CHART 1: GLOBAL SUPPLY CHAIN PRESSURE

Source: Federal Reserve New York, AssureInvest

Commodity prices have dropped over 20% in the past few months which relieves cost pressures in areas like materials and consumer staples and also helps reduce inflation expectations. Energy costs have declined recently with softer demand and new sources of supply but may remain elevated by the shift away from Russia. China recovery should add to demand in the next year while capital investment is constrained because of the shift to renewables and possible recession-related drop in demand.

Wages and services inflation tend to have more gradual cycles than goods markets. Jobs growth is slowing but it may take an extended period for wages inflation to decline. Average hourly earnings growth has lifted above pre-pandemic levels as labour markets tighten but has not kept up with the surge in overall price increases. Participation rates have recovered quickly in many regions and this has constrained wages growth. Participation in the US dropped far more dramatically than in most areas and worker pricing power is stronger because its recovery is only gradual.

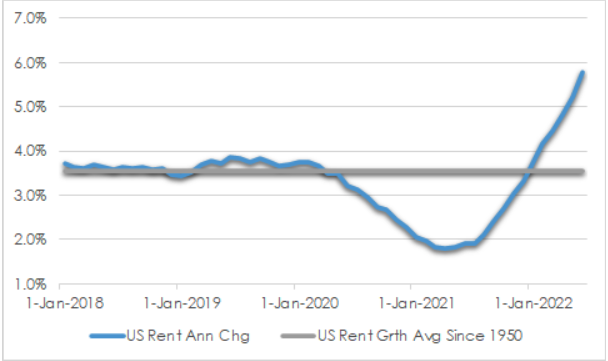

Housing rents have lifted as potential homebuyers put off purchases due to affordability concerns exacerbated by elevated house prices and recent mortgage rate increases. Rents are likely to decline in time as home values decline, but there is likely to be a reasonable lag. US rents lifted 5.8% per annum as of June 2022. Weaker employment prospects will dampen for a while the impetus to buy and build property.

CHART 2: US RENT GROWTH

Source: St Louis Fed, AssureInvest

Russia’s war in Ukraine along with growing tensions with China are encouraging a partial retreat from globalisation which has been a source of disinflation in the past several decades. Rather than seeking a shift to lowest-cost production, security of supply is an increasing focus. Movement to produce onshore or nearshore will lift cost pressures at the margin.

Implementation of technology in areas such as telecommunications, financial services and healthcare are continuing deflationary forces that are offsetting other pricing pressures.

Investment strategy

Equities are down strongly since the start of the year, yet investors should have no more than neutral exposure to the asset class. The July 2022 rebound seems to be based on the hope that inflation is peaking and the US Federal Reserve may be able to cut rates through next year. However, markets may be disappointed by the persistence of underlying inflation and the need for higher rates for longer.

The high chance of recession in the next two years means equity exposures should be focused on strong cash generating firms with structural growth and strong balance sheets able to withstand the difficult environment. We are wary of cyclicals and also previously high-flying sectors of the market with questionable businesses such as fast sales growth but no-profit technology firms.

We favour companies with pricing power such as in healthcare, packaging, energy and communication industries able to boost productivity through innovation and pay reliable and growing dividends.

Consensus earnings expectations are likely to be cut as more companies across various industries flag increasing challenges due to softer demand and higher costs. Discretionary spending should weaken as the year progresses. Supply chains are starting to ease but remain troublesome. Labour shortages and elevated wages costs are weighing on profit margins for manufacturers and increasingly on services firms which may only be covered by price increases after a lag. Balance sheets are broadly in good shape but more heavily indebted firms will begin announcing substantial interest costs. Market price/earnings of around 17 times for the US and 15 times for Australia may appear lower than they were six months ago but they are yet to fully reflect the economic growth slowdown.

We retain high cash levels and an underweighting to fixed interest where little value is offered following the downswing in yields since the middle of the year. Credit spreads have widened since January but only to around historically typical levels so there is little margin of safety for a more substantial lift in defaults than is priced in.

Andrew Doherty, director, AssureInvest