Since 2017 we have had a transfer balance cap (TBC) regime that limits the amount that can be transferred from accumulation phase to retirement phase pension accounts.

At the time of commencement, the cap was $1.6 million. A mechanism to index this amount in increments of $100,000 is covered in the income tax assessment act 1997 (ITAA). We saw the first increase of the general transfer balance cap (GTBC) to $1.7 million on 1 July 2021.

Based on recent inflation levels an increase of $200,000, to $1.9 million, is expected from 1 July 2023.

Why a $200,000 increase

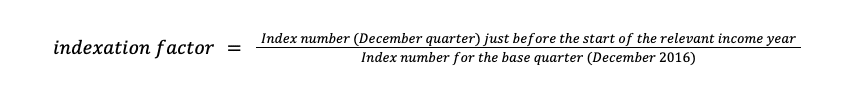

Per s960-285 (ITAA), the indexation factor is determined by:

Where index number = ‘All groups CPI’ (being the weighted average of the 8 capital cities)

= 130.8 (December 2022 ¼) / 110.0 (December 2016 ¼)

= 1.189 (rounded to three decimal places)

Then multiply this by the base amount of $1.6 million

= $1,902,400

As this exceeds a multiple of $100,000, indexation will occur. This is rounded down to the nearest $100,000, being $1.9 million. A $200,000 increase from the current $1.7 million GTBC.

Proportional indexation

From 1 July 2023, your personal transfer balance cap (PTBC) could be anywhere from $1.6 million to $1.9 million.

Proportional indexation is calculated in accordance with s294-40 (ITAA), as:

= Unused cap percentage ×Indexation amount

As mentioned above, indexation amount will be a multiple of $100,000. To determine the unused cap, you:

- Identify the highest ever balance in your TBA; and

- Identify the earliest day in which it occurs; and

- Express the balance determined at (a) as a percentage (rounded down to the nearest whole number) of your TBC on the day identified in (b); and

- Subtracting (c) from 100%

Example

Larry, Curly and Moe are members of an SMSF. They all retired and commence pensions on 1 July 2017.

- Larry started his pension with $1 million and has not commenced another since

- Curly started his pension with $1 million. He commenced a second pension on 1 July 2022 with $330,000

- Moe started his pension with $1.6 million and has not commenced any new pensions. He took a commutation of $400,000 on 1 January 2023

We can determine each member’s proportional indexation as follows:

|

Larry |

Curly |

Moe |

|

|

1/7/2021 indexation |

|||

|

Highest ever TBA balance to 30/6/2021 |

$1,000,000 |

$1,000,000 |

$1,600,000 |

|

Date of highest value |

1/7/2017 |

1/7/2017 |

1/7/2017 |

|

PTBC on that date |

$1,600,000 |

$1,600,000 |

$1,600,000 |

|

Used cap |

$1m / $1.6m = 62% |

$1m / $1.6m = 62% |

$1.6m / $1.6m = 100% |

|

Unused cap |

38% |

38% |

0% |

|

Proportional indexation 1/7/21 |

38% x $100,000 = $38,000 |

38% x $100,000 = $38,000 |

$0 |

|

1/7/2023 indexation |

|||

|

Highest ever TBA balance to 30/6/2023 |

$1,000,000 |

$1,330,000 |

$1,600,000 |

|

Date of highest value |

1/7/2017 |

1/7/2022 |

1/7/2017 |

|

PTBC on that date |

$1,600,000 |

$1,638,000 |

$1,600,000 |

|

Used cap |

$1m / $1.6m = 62% |

$1.33m / $1.638m = 81% |

$1.6m / $1.6m = 100% |

|

Unused cap |

38% |

19% |

0% |

|

Proportional indexation 1/7/2023 |

38% x $200,000 = $76,000 |

19% x $200,000 = $38,000 |

$0 |

|

PTBC on 1/7/2023 |

$1,714,000 |

$1,676,000 |

$1,600,000 |

Death benefit pensions

A death benefit pension will result in a credit (increase) to the TBA of the recipient. However, there is a difference in the timing of the credit, depending on whether it results from the reverting of an existing pension or the commencement of a new death benefit pension.

Example

Mike died on 5 February 2023 with $1.9 million in an account based pension. Carol has $1.4 million in accumulation and has never had a retirement phase pension.

If Mike’s pension was reversionary to Carol, she would receive the pension straight away. However, the credit to her TBA will not occur until 5 February 2024.

On 1 July 2023, the highest ever value in Carol’s TBA will be zero as the credit from the reverted pension is not included yet. This will give Carol a PTBC of $1.9 million, allowing her to maintain the full reverted pension in super, should she so wish.

As a side note, although not showing in Carol’s TBA, the value of the pension on 30 June will count towards her total super balance (TSB).

If Mike’s pension was non-reversionary, Carol will need to deal with the death benefit ‘as soon as practicable’. Although not legislated, it is widely accepted that action taken within six months will rarely raise concerns around acting ‘as soon as practicable’.

If Carol were to start a death benefit pension prior to 1 July 2023 the credit will occur on that day. She will be limited to the current cap of $1.7 million and face the prospect of having to withdraw any excess death benefits from the superannuation system.

If the death benefit pension is not commenced until after 30 June 2023, this would delay the timing of the credit and provide Carol with access to the higher TBC.

When Carol starts the pension will also influence whether it will count towards her TSB on 30 June 2023 or not.

Total super balance (TSB)

Indexation of the contribution cap is linked to Average Weekly Ordinary Times Earnings (AWOTE). It is anticipated the required rate will not be reached this year for an increase to occur. However, an increase in the GTBC will see an adjustment in the thresholds for non-concessional contributions (NCC).

Based on the current contribution caps, the following table highlights the difference in thresholds for this year and next:

|

Bring forward rule |

NCC cap for first year |

TSB – 30 June 2022 (current year) |

TSB – 30 June 2023 (next year) |

|

3 years to use |

$330,000 |

Less than $1.48m |

Less than $1.68m |

|

2 years to use |

$220,000 |

$1.48m to < than $1.59m |

$1.68m to < than $1.79m |

|

1 year to use (no bring forward available |

$110,000 |

$1.59m to < than $1.7m |

$1.79m to < than $1.9m |

|

N/A |

Nil |

$1.7m or more |

$1.9m or more |

It is beyond the scope of this article to consider the implications of this further.

Federal budget

The Government have already indicated that they what to finalise and legislate the objective of superannuation. This will then set the tone for any future legislative changes and reforms for the superannuation sector.

It is too early to say whether any potential changes will impact on the indexation process, or consider a freezing of the cap.

Conclusion

As the law stands, we will see an increase in the GTBC. Any strategies linked to this should consider the current law but be flexible enough to change, depending on the outcome of the budget.

By Anthony Cullen, senior SMSF technical specialist, SuperConcepts

Great article and update