Inflation and weaker growth create challenging conditions

Abundant volatility and uncertainty in the current environment instructs a cautious and flexible investment approach.

Challenging conditions reflect tightening monetary settings and stubborn inflation. Economic growth is decreasing with mild recessions likely in key regions as the year progresses. Manufacturing and construction are softening significantly given the stimulus-fuelled pull forward of demand during covid lockdowns. Services strength remains, particularly in the US, but slowdowns should be more evident as labour markets come off the boil.

Retail sales are beginning to decline as household savings built up during the pandemic are depleted. The US savings rate is now merely 2.4%, less than half its typical level. The sharp rise in consumer loans including credit card usage indicates many consumers are spending beyond their incomes. Wages growth is helping offset some of the rise in costs but is generally not keeping up with inflation. Falling house prices impose a negative wealth effect, encouraging more restrained spending patterns. More hits to confidence are coming with likely further rate rises this year.

CHART 1: US RETAIL SALES, SAVINGS RATE

Source: St Louis Fed

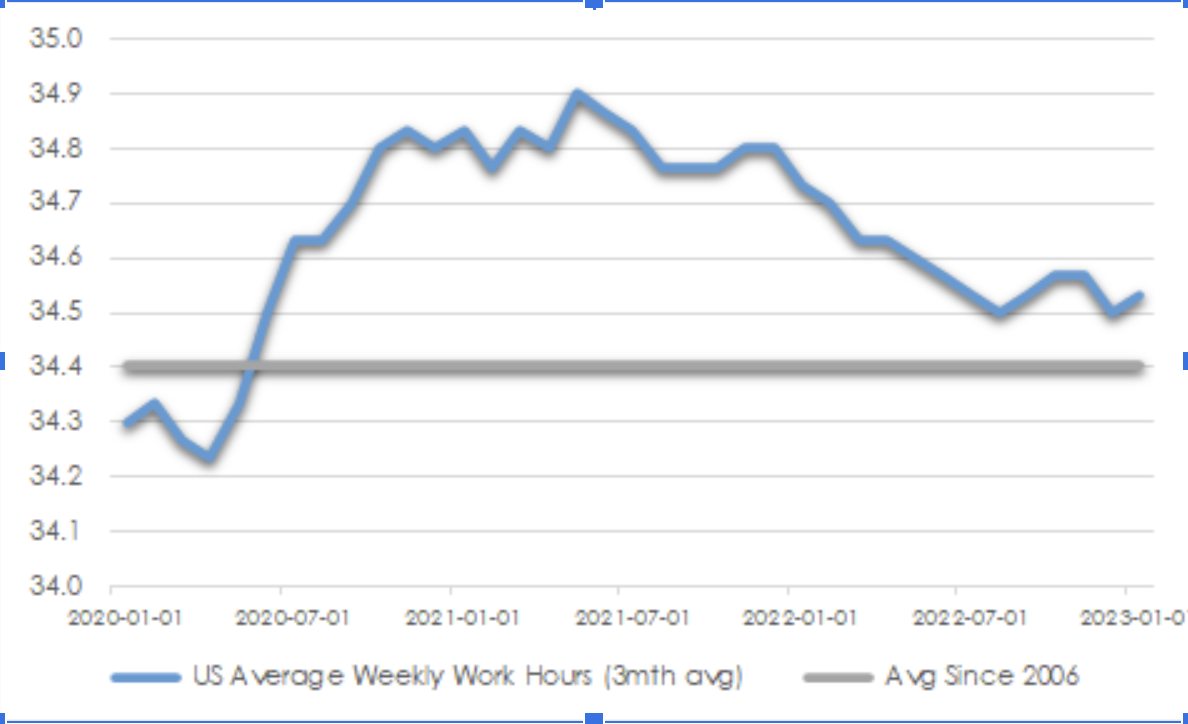

Strong jobs markets encourage central banks to raise rates further and hold them there for longer. Yet weakness will come. US unemployment of merely 3.4% could well be a percentage point higher in a year or so, implying many thousands of job losses per month. Numerous companies are hoarding workers given the shortage of skilled labour but have already reduced staff costs by cutting working hours.

CHART 2: US HOURS WORKED

Supply and demand taking time to rebalance

Persistently elevated underlying inflation and strong jobs markets maintain the pressure on central banks to raise policy rates. Considering how little inflation has reduced in the last year, there may be much more work yet to do. Inflation in the United States was 6.4% in the year to December 2022, down relatively little on the 7.1% recorded for the year earlier. Signs abound that inflation is moderating, yet there remains a large gap to the US Federal Reserve’s 2% target.

The inflation surge since the beginning of 2021 emanated from supply shocks only now beginning to resolve. These shocks relate to the war in Ukraine, extended lockdowns in key Chinese port cities and company struggles to find workers, compounded by disruptions to migration.

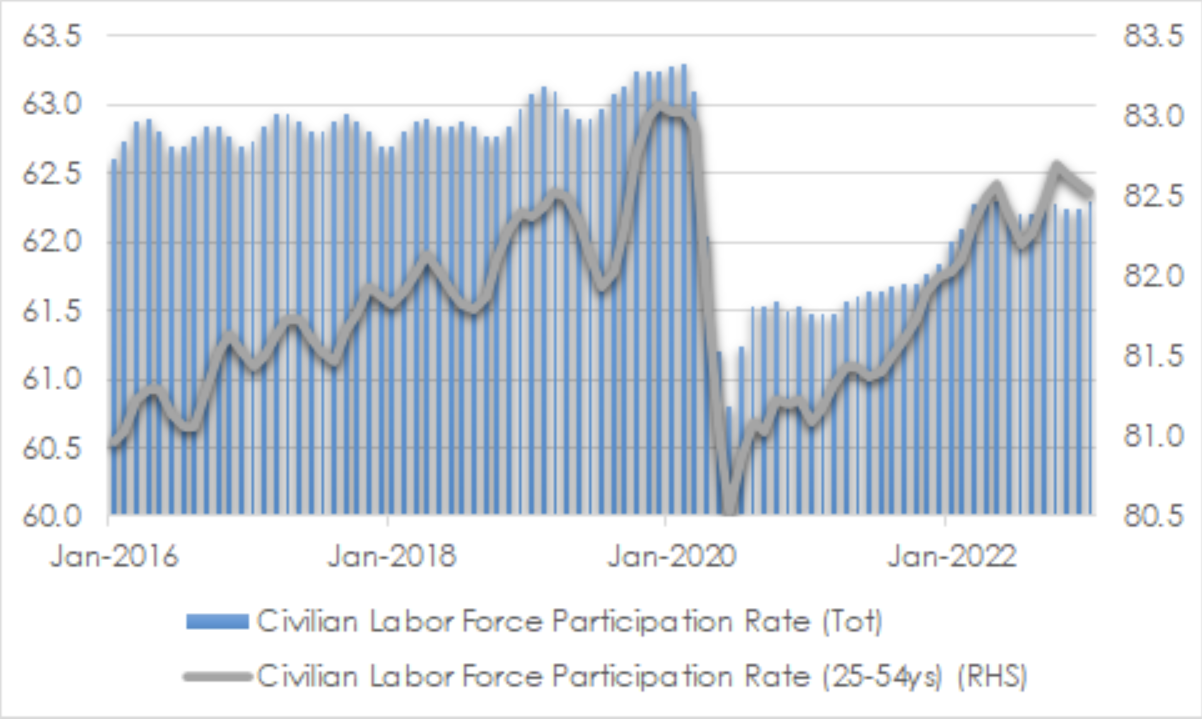

US labour supply issues have been exacerbated by the post-pandemic fall in US workforce participation through early retirements and need for many to stay home to look after others. Younger workers have merely trickled back in over recent months.

CHART 3: US WORKFORCE PARTICIPATION

Source: St Louis Fed

Supply will eventually catch up with slowing demand. However, labour markets can take a long time to correct, so wages, and therefore services inflation, could take a long time yet before softening enough to allow broad inflation to return to central bank targeted levels.

Companies have increasingly preferenced resilience over efficiency given the significant supply issues plus growing geopolitical tensions particularly between the US and China. Globalisation is a least partially reversing so a key deflationary force of recent decades is evaporating.

China’s reopening may provide a base for commodity prices in the near term. Underinvestment in new oil and gas supply could support prices at higher levels than many individuals anticipate. Meanwhile, the shift to alternative and sustainable energy sources will reduce efficiencies of scale and could keep headline inflation measures higher over the medium term.

Monetary policy tighter for longer

Official cash rates are likely to shift and stay higher than many investors expect. The US Federal Reserve wishes to re-establish its credibility in fighting inflation so will not want to start accommodating once more until underlying inflation is firmly around its 2% target. This credibility was severely damaged when extraordinary stimulus was maintained well into 2021 despite the signs that prices were surging. Political pressure on the central bank will grow as the US presidential election draws nearer next year, so it will be keen to be well along its path of inflation moderation by that time.

The US Fed Funds rate now 4.50-4.75%, up from close to zero a year ago, could well be 50-100 basis points higher over the next several months. Likewise, the European Central Bank predicts inflation this year well above its target, so further hikes of at least 50-100 basis points are likely so that policy may be sufficiently restrictive. The Bank of Japan has been an outlier by retaining its extraordinary monetary stimulus. However, the allowed range of yields on longer term bonds has recently been widened modestly which may indicate that yield curve control measures will be abandoned soon.

The Fed is also reducing the size of its balance sheet which blew out through bond purchases as part of extraordinary stimulus in the decade after the global financial crisis in 2008/9. The impact of this unwind is difficult to ascertain but economic activity must be decreased to some degree through reduced financial market liquidity.

Investment strategy

Abundant volatility and uncertainty instruct a cautious and flexible investment approach. Many investors will be disappointed by the looming downward pressure on earnings exacerbated by inflation and interest rates stubbornly higher than many are hoping.

Yield has returned, so expected returns over our forecast horizon over the next five years are lifted relative to the decade following the 2008/9 financial crisis when interest rates were around zero. Cash has become a more attractive asset class yielding 3-4% over our forecast period, lifting the bar on allocating funds toward riskier investment propositions. Our overweight to cash remains.

We remain neutral equities overall. Corporate margins are likely to be squeezed by lower revenues as discretionary spending fades while wages and other business costs remain elevated. Management guidance is likely to be cautious given the ambiguous outlook.

The rally in US equities in the early part of 2023 reduces our estimated returns over the next five years and reinforces our modestly underweight exposure to that region. The very modest growth outlook for the next few years is well and truly priced in. Far better value is available in European and Japanese equities which currently benefit from far more pessimistic investor assumptions.

In Australian equities, risks associated with inflation, interest rates and weaker growth in advanced economies encourage a focus on enduring growth businesses better able to pass higher costs on to customers. Defensive sectors like consumer staples and healthcare are likely to outperform. Some value is available amongst technology and other growth businesses following heavy selloffs last year. Cyclical firms may disappoint investors through weaker earnings in coming months so we will look for bargains in those entities most likely to benefit from an eventual improvement in the economic environment. China’s reopening favours energy and other resources stocks though these areas are due for a pullback following recent strong gains.

In real estate, transaction volumes and asset prices are being pressured by rising interest rates and weakening discretionary spending though these issues are largely priced in while underlying tenant fundamentals remain solid.

Fixed interest yields are higher than a year ago but much of these are devoured by inflation. We remain underweight the asset class. We hold only modest credit allocations due to threat of spread widening as growth weakens and shorter duration than the benchmark given the likelihood that the Reserve Bank of Australia’s slow rate rise path will allow long bond yields to drift higher in time.

Andrew Doherty, director, AssureInvest