A common theme to the questions is that the relevant funds have generally had some form of segregation being applied prior to the contribution being received. If not for the contribution, it is likely that the segregated method of claiming Exempt Current Pension Income (ECPI) would be available to the fund.

Contribution reserving strategy

The name itself for this strategy is a misnomer, as the ATO have confirmed that setting aside contributions prior to allocating them to a member is not a reserve, per se. It is more akin to a having the amount in a holding, or suspense account.

The strategy is made possible due to the provisions of SIS regulation 7.08 that requires contributions made to an SMSF be allocated to a member, not later than 28 days after the end of the month in which the contribution is received. It is worth noting that this is unique to SMSFs, APRA regulated funds are required to allocate certain contributions no later than three business days after both the contribution and relevant information has been received by the fund trustee. Generally, these will be contributions made by an employer via SuperStream.

For contributions received by an SMSF in June, this will mean the trustees have until 28 July to allocate the amount to a member. The importance of the strategy is that the contribution is taxable (where applicable) in the year the fund receives it. Any potential deduction is also claimed in the year of payment. However, the amount will not count towards the member’s contribution cap until the year it is allocated to the member.

Claiming Exempt Current Pension Income

Where a superannuation fund is supporting retirement phase pension accounts, it is generally able to claim any income derived from the assets supporting those pension accounts as exempt from fund income tax. The claim for ECPI can be made using either the ‘segregated’ method (section 295-385 ITAA 1997) or the proportionate method (section 295-390 ITAA 1997). In some cases, both methods are used in the same income year.

An actuarial certificate will not be required where the segregated method of claiming ECPI is used. Consequently, there is no choice as to whether or not to claim ECPI where the segregated method applies. Although it is beyond the scope of this article to go into greater detail, it is acknowledged that Disregarded Small Fund Assets (DSFA) may prohibit a fund from using the segregated method. This does not stop a fund from segregating assets for investment, or member choice purposes.

Where the proportionate method is used to claim ECPI, a certificate must be obtained from an actuary before the date for lodgement of the fund’s return for the year. Unlike the segregated method, claiming ECPI under the proportionate method is a choice, as there is no legal requirement to obtain an actuarial certificate. However, where the relevant actuarial certificate is not obtained by the required time, the fund cannot claim ECPI under the proportionate method. This allows for times where it would not be worthwhile to claim ECPI where the proportionate method applies, for example, the fund may have available significant tax losses and/or the retirement phase pension commences late in the income year.

Is there an interaction between the two?

A contribution to a fund, whether it is allocated to a member or not, will become an asset of the fund. The more common type of contribution will be a deposit to the fund’s bank account, with in-specie transfer of assets another popular option.

Where the value of these contributions is not allocated to a member, they will generally be recorded as a liability to the fund, either in the liability section of the Statement of Financial Position or in the Member’s Equity section, but separate from the actual member’s interest.

When considering claiming ECPI under the segregated method, legislative reference is made to the assets of the fund, at a time, being invested or otherwise being dealt with for the sole purpose of enabling the fund to discharge all or part of its liabilities in respect of retirement phase income streams. Further, reference is made to the fact that if the market value of the assets set aside to support the retirement phase income streams exceeds the value of those benefits, they will not be segregated pension accounts.

Making a cash contribution to a fund’s bank account, that was previously segregated to retirement phase pension interests, without increasing the value of those interest (remember a contribution cannot be made to a pension account) would result in that asset (the bank account) no longer being a segregated current pension asset. Likewise, in-specie transfers are not going to increase the value of the pension interest either and the asset so transferred would also not be a segregated current pension asset.

Unless the trustees make a prospective, conscious decision to run sub-accounts for the bank account receiving the contribution and/or segregate specific assets to the pension accounts, the assets of the fund will no longer be segregated. How many trustees will take such actions when a short term, contribution reserving strategy is being implemented?

In most cases, one would expect that the majority of funds would no longer be seen as segregated from the time the contribution is received, and this would preclude them from claiming ECPI under section 295-385 (segregated method) from that point on. It may, however, be possible to claim the fund as segregated prior to that point. This leaves the option of using the proportionate method to claim ECPI from the time the contribution is received.

Where it can get interesting is how the proportion of any ECPI is calculated under this method. Unlike the segregated method, that makes reference to the assets of the fund, the proportionate method makes reference to the liabilities of the fund, as follows;

Average value of current pension liabilities divided by Average value of superannuation liabilities

Where:

- “average value of current pension liabilities” is the average value for the income year of the fund’s current liabilities (contingent or not) in respect of retirement phase superannuation income stream benefits of the fund at any time in that year. This does not include liabilities for which segregated current pension assets are held.

- “average value of superannuation liabilities” is the average value for the income year of the fund’s current and future liabilities (contingent or not) in respect of superannuation benefits in respect of which contributions have, or were liable to have, been made. This does not include liabilities for which segregated current pension assets or segregated non-current assets are held.

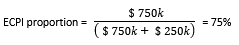

Let’s apply this formula to a simple example. Say we have a fund with two members. Member 1 has a retirement phase pension of $750,000 and member 2 has an accumulation interest of $250,000.

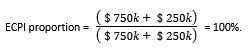

What happens though, if both members are in retirement phase pension and then member 1 makes a concessional contribution in June of $20,000, that is set aside and not allocated until early July, i.e., the next income year? Assume the financial statements show this amount as a liability. Will this amount be incorporated into the above formula, or will it sit outside as it is not being recorded as a member/superannuation benefit?

We have already determined that the fund would not be segregated from the time member 1 makes the contribution and could not apply ECPI under the segregated method. When applying the proportionate method and only looking at what appears to be superannuation benefits, per the above definition, do we have a situation where the formula will look like this:

The argument being that the $20,000 contribution is not a member interest, or superannuation liability as it has not been allocated to the member yet and therefore does not feature in the formula.

Do reporting obligations and Total Super Balance (TSB) play a role?

The instructions to the SMSF Annual Return confirm that when reporting contribution details in section F (member information) that amounts that are not allocated until the subsequent year must still be reported for the year in which they are received by the fund. That is, despite the amounts not being allocated until year 2, for the trustees of a fund to complete the annual return correctly, they must first know who the contributions are for and report as such in year 1.

These reported amounts will flow through to other parts in section F of the return, namely items X1. Item X1 is then used to help calculate the ‘accumulation phase value’ of the individual. Some may argue that item X1 can be changed to record a lower value by excluding the amount not allocated, as it doesn’t belong to the member at that point in time.

Section 307-230 ITAA 1997 tells us that, among other balances, an individual’s ‘accumulation phase values’ will count towards their TSB. Section 307-205 defines accumulation phase value to include the total amount of the superannuation benefits that would become payable if the individual voluntarily caused the interest to cease at that time.

When considering this definition, it is hard to argue that the amount doesn’t belong to the member (whether allocated to them or not) as any member who voluntarily caused the interest to cease, at that time, would expect to receive the amount that has been contributed as part of any benefit payment or rollover. Not forgetting the amount has also been recorded as a contribution by/for them in the SMSF annual return.

Returning to our example above, where member 1 has contributed $20,000 to the fund, regardless of whether this is allocated to them or the contribution reserving strategy, it would be expected the value (net of tax) would be included in the denominator of the formula. Bringing the ECPI down to approximately 98%.

Conclusion

Except in the rare occasions where trustees of a fund may have proactively and prospectively engaged in segregating assets to retirement phase pension interests, the use of a contribution reserving strategy will lead to the option of claiming ECPI under the proportionate method.

Contributions not allocated to the member in the year received will generally still be linked to the member and included in the overall value of the ‘average value of the superannuation benefits’ when it comes to determining ECPI. For any trustee wishing to claim ECPI under the proportionate method, they will need to obtain an actuarial certificate for that relevant period.

Speak to your fund’s actuary where this scenario arises for guidance on how to maximise the SMSF’s claim for ECPI.