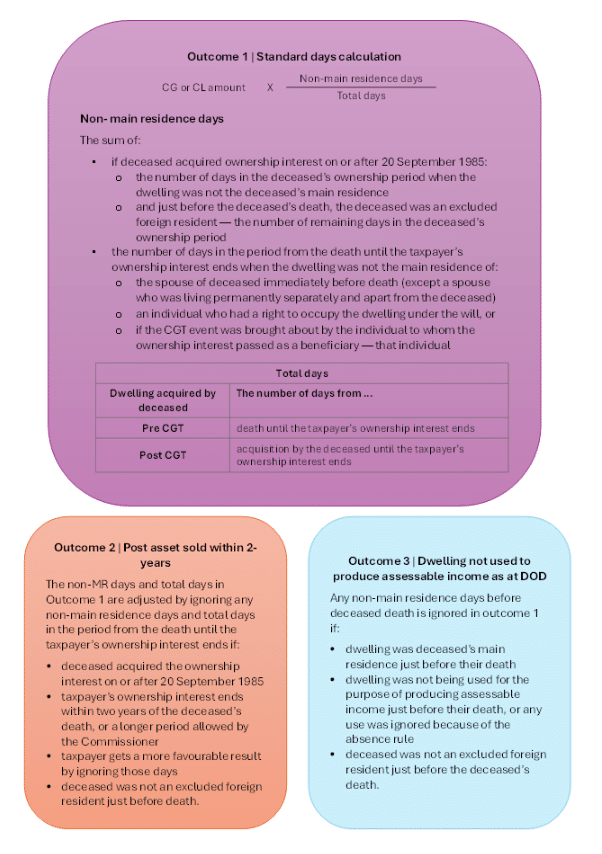

In fact, the main residence exemption may result in no tax being payable by a beneficiary, even if the property was income producing by the deceased at some point in their ownership period. In other instances, the way that non-main residence days are calculated may produce a more favourable result.

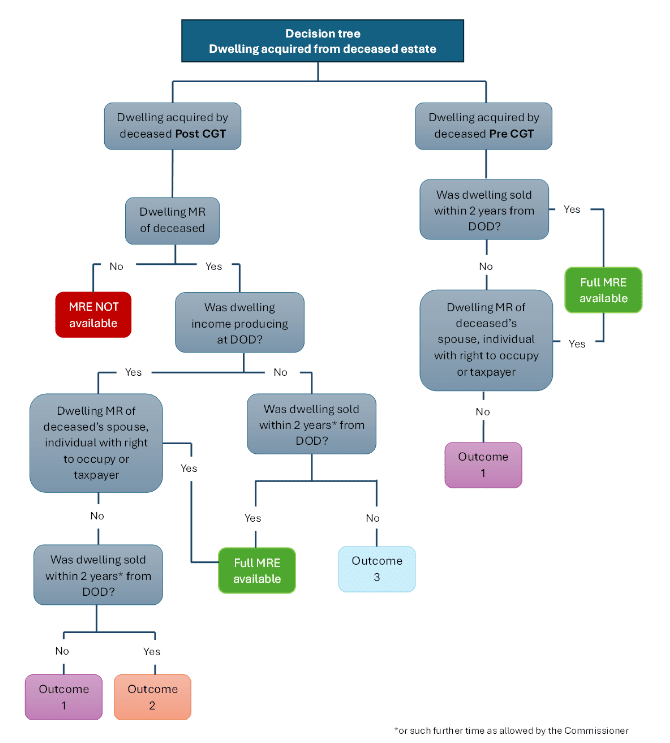

The operation of the provisions that provide for the calculation of any main residence exemption flowing through a deceased estate are intricate, with several variables that can impact the tax outcome. These variables include:

- whether the deceased’s dwelling was a pre or post CGT asset

- whether the dwelling was income producing as at the deceased’s date of death (DOD)

- whether the deceased’s dwelling was, from the time of their death until the relevant CGT occurred, the main residence (MR) of the deceased’s spouse, someone with a right to occupy the property under the will or the taxpayer

- whether or not the property was sold within two years of the deceased death (or such further time as allowed by the Commissioner).

- the taxpayer is an individual and the ownership interest passed to them as a beneficiary in a deceased estate, or the taxpayer owned it as the trustee of a deceased estate

- the deceased was not an excluded foreign resident just before death

- the conditions in the table below are satisfied.

|

Item |

One of these items is satisfied |

And also one of these items |

|

1 |

the deceased acquired the ownership interest on or after 20 September 1985 and the dwelling was the deceased’s main residence just before the deceased’s death and was not then being used for the purpose of producing assessable income |

the taxpayer’s ownership interest ends within 2 years of the deceased’s death, or within a longer period allowed by the Commissioner |

|

2 |

the deceased acquired the ownership interest before 20 September 1985 |

the dwelling was, from the deceased’s death until when the taxpayer’s ownership interest ends, the main residence of one or more of:the spouse of the deceased immediately before the death (except a spouse who was living permanently separately and apart from the deceased) an individual who had a right to occupy the dwelling under the deceased’s will if the CGT event was brought about by the individual to whom the ownership interest passed as a beneficiary — that individual |

Tip

PCG 2019/5 outlines circumstances where the ATO will allow a longer period under item 1 above, where the dwelling could not be sold and settled within two years of the deceased’s death due to reasons beyond the taxpayer’s control that existed for a significant portion of the first two years.

If s 118-195 does not apply a full MRE will not be available. A partial exemption may nonetheless be available to the taxpayer, under s. 118-200.

As per s. 118-200, a partial exemption (or no exemption) is available where:

- the taxpayer is an individual and their ownership interest in a dwelling passed to them as a beneficiary in a deceased estate, or they owned it as the trustee of a deceased estate and

- s. 118-195 does not apply (e.g. the table above did not apply).

The below is a decision tree that works though these provisions.