Solving the in-house asset compliance maze (Part 2)

The interaction between the IHA rules and Part 8 of SIS underscores the legislation’s holistic approach to SMSF compliance and is key to solving the in-house asset (IHA) compliance maze.

While a fund may invest in IHAs within the prescribed limits, breaches of the 5% IHA threshold trigger specific reporting requirements in sections s82, s83 and s84 SIS.

Understanding the nuances of the IHA breaches is essential to ensure SMSF compliance.

s82 SIS

Where the IHA level exceeds 5% at the end of the income year, the fund triggers s82 SIS and the trustees must prepare a written plan by the end of the following income year that:

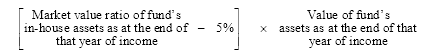

- Specifies the excess amount worked out using the formula:

- Set out the steps to reduce the limit of the fund’s IHA ratio to 5% or less during the following year of income.

- Each trustee must ensure that the steps in the plan are carried out.

Where the fund cannot dispose of assets to reduce the IHA level back to the 5% complying level, the fund must dispose of the IHA to meet the governing legislation by the end of the next following year of income.

Timing of Trustee Obligations

The timing of the trustee’s response to triggering s82 at the end of the financial year (“Y0”) plays a crucial role in determining whether a breach of s82 exists.

The trustee must undertake action or prepare a plan and reduce the level of IHA to 5% or less by the end of the following year of income (“Y1”).

There is no breach of s82 in Y1 because s82 requires trustees to take corrective action in Y1.

Where the trustees fail to meet their obligations in Y1, they will breach s82 in the subsequent year of income (“Y2”), with the SMSF auditor reporting the breach to the ATO in an ACR in Y2.

If the level of IHA reduces to 5% or less in Y1 because of changes to the market value of fund assets, the trustee is still required to meet their obligations under s82.

A change in market values in Y1 does not remove the requirement to rectify a breach triggered in Y0 in line with s82.

Timing of Auditor Obligations

Upon signing the audit report in Y1, the auditor requests the written plan from the trustees and outlines their responsibilities under s82 in the management letter.

However, if the trustees fail to provide a written plan or do not reduce the IHA level to 5% or less by the end of Y1, the auditor must report the s82 breach to the ATO in Y2.

If the Y0 audit is conducted in Y2 for any reason, such as late lodgment, the fund is deemed to have triggered s82 in Y0 but did not meet the requirements of s82 by Y1.

Under this scenario, the auditor has no discretion but to report the s82 breach to the ATO in Y2.

s83 SIS

Where the IHA level exceeds 5% at any time during Y0, s83 will apply as a reportable breach in that year because trustees must not acquire an in-house asset that exceeds 5% of the market value ratio.

Unlike s82, which focuses on breaches at a specific time (i.e. the end of the income year), s83 addresses breaches that occur at any time during the income year.

For instance, when an asset exceeds the 5% IHA level at any time during Y0 but is subsequently reduced to 5% or less or disposed of before the end of Y0, the fund has breached s83.

The SMSF auditor has no discretion and must report the s83 breach to the ATO in an ACR.

How Does a Lease Arrangement Work?

While a loan or an investment in a related party can exceed the 5% IHA level during an income year, there is confusion when the IHA is an asset subject to a lease or lease arrangement.

The problem is understanding whether it is the lease or the asset, which is the IHA.

In line with s71 SIS, the definition says it is “an asset subject to a lease or lease arrangement”, meaning the asset is the IHA, not the lease.

During the Year

By way of example, when a related party uses residential property during Y0, the asset is an IHA from when the related party first uses it until they vacate the property.

Assume an SMSF owns a residential property rented to a related party on 1 September and vacates it on 31 December.

The property is an IHA of the fund from 1 September until 31 December.

Where the value of the IHA asset ratio exceeded 5% during that period, the fund breaches s83 SIS and the SMSF auditor must report the breach to the ATO.

A s83 breach will not trigger a s82 breach because there is no IHA issue at the end of Y0, only during the year.

At the End of the The Year

Where the residential property continues to be occupied on June 30 and IHA exceeds the 5% level at the end of Y0, the fund still breaches s83 because s83 applies at any time of the year.

Essentially, the fund will trigger the requirements under s82 (which is not reportable in that year of income) but will breach s83, which is reportable to the ATO.

s84 SIS

s84 SIS requires SMSF trustees to take all reasonable steps to comply with the IHA rules and apply to the fund anytime during the year.

The overarching principle guiding the application of s84 is that whenever an s83 breach exists, an s84 breach is also reported to the ATO in an ACR. The mechanics of applying s84 are the same as outlined in the s83 section above.

Conclusion

Solving the SMSF compliance maze of IHA breaches requires a nuanced understanding of the legislative framework and meticulous attention to detail.

As SMSF professionals continue to navigate the evolving regulatory landscape surrounding IHA breaches, it is imperative to stay informed about legislative updates, ATO guidelines, and best practices in assessing SMSF compliance.