Budget Week

"What would you like to see in the 2018 federal Budget for tax?"

As we fast approach the 2018 Federal Budget, technical experts have highlighted some of the areas where they would like to see reforms. The SMSF industry is hoping the government will address some of the residual issues left over from the major super change, reduce some of the costs and levies but overall commit to a period of stability for the super system.

Tim Miller, founder, Miller Super Solutions

Tim Miller, founder, Miller Super SolutionsI would hope that a number of the announcements are around fixing up the issues associated with the super reforms. [Some issues remain] in relation to some of the rules with the transfer balance cap, defined benefit and market linked pensions, and insurance with reversionary pensions and anomalies with death benefits now that we can roll over death benefits.

So I would hope that there are some of those necessary legislative fixes to simplify some of the reform issues.

I know that various industry lobby groups have targeted areas like the definition of an Australian super fund and some of those legacy pension issues, which could be addressed in the budget, but I also won’t hold my breath

[Fixing the issues with] legacy pensions is not exactly political point scoring subject matter. If you make changes to legacy pensions well you might win the vote of 200 people, well that's neither here or there to a government. So they're looking more at big ticket items rather than what might actually simplify the system, and so it's more of a hope than an expectation with those sorts of announcements.

Ian Burgess, partner, EY

Ian Burgess, partner, EYWhat we probably say upfront is not a lot. After all the changes that we had last year, I think we should be looking for a bit of stability for a significant period of time. I think the constant tinkering erodes confidence generally but including for SMSFs.

There is one major anomaly which I think should really be addressed and that is the 'death tax', the 15 per cent tax on benefits paid out to adult kids who are by definition are non-dependents. So if you have a member aged 60 plus, they can take their money out tax free while they are alive but when they die if the monies go to children who are not tax dependent, so over 18, then there's a 15 per cent tax payable on the taxable component.

I don't know the number but I suspect the government collects very little of that tax because there is so much time and effort in the industry put into planning around that- enduring powers of attorney, for money to be withdrawn while the member is still alive, etc. To me it doesn't make sense if the member can take the money out tax free over 60 then on their death it should come out tax free regardless of who it goes to.

Darren Wynen, chief executive, Insyt

Darren Wynen, chief executive, InsytLevies impacting on the superannuation system – SMSF trustees has been subject to a sustained run of increased costs, including: the AFS licensing reforms, an increase in the SMSF levy, the 2017 superannuation reforms and now the proposed changes to SMSF auditor levies. These cost increases take away from the ability of self-funded retirees to save for their future and should be subject to an independent review – given that self-funded retirees counterbalance the Aged pension.

CGT relief – the complexity of the CGT relief and the burden resting with practitioners to adapt their clients to the 2017 superannuation reforms means that, in my view, the time for an SMSF to choose to apply the CGT relief should be extended by 12 months to 2 July 2019.

Financial services reforms – the financial services reforms continue to frustrate accountants and are viewed by many as unnecessary. There continues to be confusion around how the exemptions for accountants operate.

Restrictions on drawing down super – although I may be unpopular for saying this, I believe that the sustainability of SMSFs depends in part of members utilising their savings to fund their retirement and not removing a large chunk of their superannuation savings upon attaining age 65, or earlier on retirement. We do see occasions where the superannuation is immediately withdrawn upon reaching age 65 and the member is then dependent on Government support. I believe that there should either be incentives to encourage people to manage their drawdowns over the longer term (such as limits on the rate of drawdown).

Removal of restrictions on people contributing to super – I also believe that individuals should be permitted to contribute to superannuation, irrespective of their age – once again, to reduce the number of people dependant on the Aged pension system and encourage the sustainability of superannuation.

Brad Eppingstall, director, RSM Australia

Brad Eppingstall, director, RSM AustraliaNothing in relation to superannuation other than the already announced expansion of SMSF membership to a maximum of six members. The July 2017 reforms are still being implemented and bedded down now. The last thing we need is more reform. It is time to provide some stability and confidence in the superannuation system and take the time to assess the impact of the last reforms on the system.

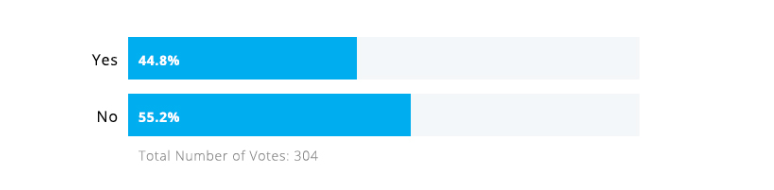

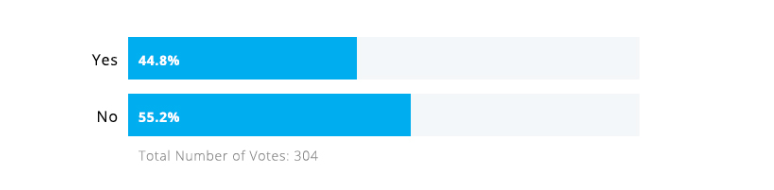

"Are you confident superannuation changes will be off the table in the 2018 federal budget?"

"What would you like to see in the 2018 federal Budget for tax?"

As we fast approach the 2018 Federal Budget, technical experts have highlighted some of the areas where they would like to see reforms. The SMSF industry is hoping the government will address some of the residual issues left over from the major super change, reduce some of the costs and levies but overall commit to a period of stability for the super system.

Tim Miller, founder, Miller Super Solutions

Tim Miller, founder, Miller Super SolutionsI would hope that a number of the announcements are around fixing up the issues associated with the super reforms. [Some issues remain] in relation to some of the rules with the transfer balance cap, defined benefit and market linked pensions, and insurance with reversionary pensions and anomalies with death benefits now that we can roll over death benefits.

So I would hope that there are some of those necessary legislative fixes to simplify some of the reform issues.

I know that various industry lobby groups have targeted areas like the definition of an Australian super fund and some of those legacy pension issues, which could be addressed in the budget, but I also won’t hold my breath

[Fixing the issues with] legacy pensions is not exactly political point scoring subject matter. If you make changes to legacy pensions well you might win the vote of 200 people, well that's neither here or there to a government. So they're looking more at big ticket items rather than what might actually simplify the system, and so it's more of a hope than an expectation with those sorts of announcements.

Ian Burgess, partner, EY

Ian Burgess, partner, EYWhat we probably say upfront is not a lot. After all the changes that we had last year, I think we should be looking for a bit of stability for a significant period of time. I think the constant tinkering erodes confidence generally but including for SMSFs.

There is one major anomaly which I think should really be addressed and that is the 'death tax', the 15 per cent tax on benefits paid out to adult kids who are by definition are non-dependents. So if you have a member aged 60 plus, they can take their money out tax free while they are alive but when they die if the monies go to children who are not tax dependent, so over 18, then there's a 15 per cent tax payable on the taxable component.

I don't know the number but I suspect the government collects very little of that tax because there is so much time and effort in the industry put into planning around that- enduring powers of attorney, for money to be withdrawn while the member is still alive, etc. To me it doesn't make sense if the member can take the money out tax free over 60 then on their death it should come out tax free regardless of who it goes to.

Darren Wynen, chief executive, Insyt

Darren Wynen, chief executive, InsytLevies impacting on the superannuation system – SMSF trustees has been subject to a sustained run of increased costs, including: the AFS licensing reforms, an increase in the SMSF levy, the 2017 superannuation reforms and now the proposed changes to SMSF auditor levies. These cost increases take away from the ability of self-funded retirees to save for their future and should be subject to an independent review – given that self-funded retirees counterbalance the Aged pension.

CGT relief – the complexity of the CGT relief and the burden resting with practitioners to adapt their clients to the 2017 superannuation reforms means that, in my view, the time for an SMSF to choose to apply the CGT relief should be extended by 12 months to 2 July 2019.

Financial services reforms – the financial services reforms continue to frustrate accountants and are viewed by many as unnecessary. There continues to be confusion around how the exemptions for accountants operate.

Restrictions on drawing down super – although I may be unpopular for saying this, I believe that the sustainability of SMSFs depends in part of members utilising their savings to fund their retirement and not removing a large chunk of their superannuation savings upon attaining age 65, or earlier on retirement. We do see occasions where the superannuation is immediately withdrawn upon reaching age 65 and the member is then dependent on Government support. I believe that there should either be incentives to encourage people to manage their drawdowns over the longer term (such as limits on the rate of drawdown).

Removal of restrictions on people contributing to super – I also believe that individuals should be permitted to contribute to superannuation, irrespective of their age – once again, to reduce the number of people dependant on the Aged pension system and encourage the sustainability of superannuation.

Brad Eppingstall, director, RSM Australia

Brad Eppingstall, director, RSM AustraliaNothing in relation to superannuation other than the already announced expansion of SMSF membership to a maximum of six members. The July 2017 reforms are still being implemented and bedded down now. The last thing we need is more reform. It is time to provide some stability and confidence in the superannuation system and take the time to assess the impact of the last reforms on the system.

"Are you confident superannuation changes will be off the table in the 2018 federal budget?"